Business, 04.12.2019 07:31, brianna8739

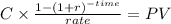

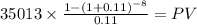

E21-6 (l04) excel (lessor entries; sales-type lease) crosley company, a machinery dealer, leased a machine to dexter corporation on january 1, 2017. the lease is for an 8-year period and requires equal annual payments of $35,013 at the beginning of each year. the first payment is received on january 1, 2017. crosley had purchased the machine during 2016 for $160,000. collectibility of lease payments is reasonably predictable, and no important uncertainties surround the amount of costs yet to be incurred by crosley. crosley set the annual rental to ensure an 11% rate of return. the machine has an economic life of 10 years with no residual value and reverts to crosley at the termination of the lease.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 07:00, ladybugys

Pennewell publishing inc. (pp) is a zero growth company. it currently has zero debt and its earnings before interest and taxes (ebit) are $80,000. pp's current cost of equity is 10%, and its tax rate is 40%. the firm has 10,000 shares of common stock outstanding selling at a price per share of $48.00. refer to the data for pennewell publishing inc. (pp). pp is considering changing its capital structure to one with 30% debt and 70% equity, based on market values. the debt would have an interest rate of 8%. the new funds would be used to repurchase stock. it is estimated that the increase in risk resulting from the added leverage would cause the required rate of return on equity to rise to 12%. if this plan were carried out, what would be pp's new value of operations? a. $484,359 b. $521,173 c. $584,653 d. $560,748 e. $487,805

Answers: 1

Business, 22.06.2019 10:00, annafellows

Cynthia is a hospitality worker in the lodging industry who prefers to cater to small groups of people. she might want to open a

Answers: 3

Business, 22.06.2019 22:00, kyle65

Anheuser-busch inbev is considering you for an entry-level brand management position. you have been asked to prepare an analysis of the u. s. craft beer industry as part of the selection process. prepare a 3-5 page report that includes a description of the industry’s strategically relevant macro-environmental components, evaluates competition in the industry, assesses drivers of change and industry dynamics, and lists industry key success factors. the company’s management also asks that you propose the basic elements of a strategic action plan that will allow the company to improve its competitive position in the market for craft beer. you must provide a heading in your report for each of the required elements of the assignment.

Answers: 3

Business, 23.06.2019 04:50, sariyamcgregor66321

Can someone me with general journal entry on this? ?

Answers: 3

Do you know the correct answer?

E21-6 (l04) excel (lessor entries; sales-type lease) crosley company, a machinery dealer, leased a...

Questions in other subjects:

Computers and Technology, 22.01.2020 21:31

History, 22.01.2020 21:31

Social Studies, 22.01.2020 21:31

Chemistry, 22.01.2020 21:31

Mathematics, 22.01.2020 21:31

Social Studies, 22.01.2020 21:31

Social Studies, 22.01.2020 21:31