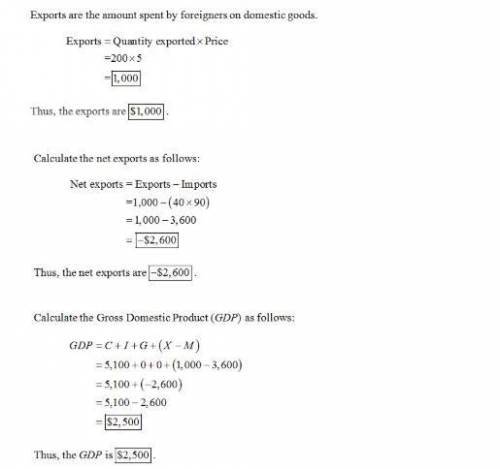

Yakov orders 40 cases of mescal from a mexican distributor at a price of $90 per case. 2. a u. s. company sells 200 spark plugs to a korean company at $5.00 per spark plug. 3. charles, a u. s. citizen, pays $1,500 for a laptop he orders from microell (a u. s. company).complete the following table by indicating how the combined effects of these transactions will be reflected in the u. s. national accounts for the current year. hint: be sure to enter a "0" if none of the transactions listed are included in a given category and to enter a minus sign when the balance is negative. amount (dollars)consumption investment government purchases imports exports net exports gross domestic product (gdp)

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 02:00, whatistheinternetpas

True or false: a smart store layout moves customers in and out as fast as possible. a) true b) false

Answers: 2

Business, 22.06.2019 07:10, Pipemacias1711

9. tax types: taxes are classified based on whether they are applied directly to income, called direct taxes, or to some other measurable performance characteristic of the firm, called indirect taxes. identify each of the following as a “direct tax,” an “indirect tax,” or something else: a. corporate income tax paid by a japanese subsidiary on its operating income b. royalties paid to saudi arabia for oil extracted and shipped to world markets c. interest received by a u. s. parent on bank deposits held in london d. interest received by a u. s. parent on a loan to a subsidiary in mexico e. principal repayment received by u. s. parent from belgium on a loan to a wholly owned subsidiary in belgium f. excise tax paid on cigarettes manufactured and sold within the united states g. property taxes paid on the corporate headquarters building in seattle h. a direct contribution to the international committee of the red cross for refugee relief i. deferred income tax, shown as a deduction on the u. s. parent’s consolidated income tax j. withholding taxes withheld by germany on dividends paid to a united kingdom parent corporation

Answers: 2

Business, 22.06.2019 10:00, bob7220

Your father offers you a choice of $120,000 in 11 years or $48,500 today. use appendix b as an approximate answer, but calculate your final answer using the formula and financial calculator methods. a-1. if money is discounted at 11 percent, what is the present value of the $120,000?

Answers: 3

Do you know the correct answer?

Yakov orders 40 cases of mescal from a mexican distributor at a price of $90 per case. 2. a u. s. co...

Questions in other subjects:

Mathematics, 01.04.2021 17:40

English, 01.04.2021 17:40

Social Studies, 01.04.2021 17:40

Mathematics, 01.04.2021 17:40

Mathematics, 01.04.2021 17:40

Mathematics, 01.04.2021 17:40