Business, 04.12.2019 00:31, cancerbaby209

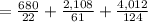

Lindsay electronics, a small manufacturer of electronic research equipment, has approximately 6 comma 800 items in its inventory and has hired joan blasco-paul to manage its inventory. joan has determined that 10% of the items in inventory are a items, 31% are b items, and 59% are c items. she would like to set up a system in which all a items are counted monthly (every 22 working days), all b items are counted quarterly (every 61 working days), and all c items are counted semiannually (every 124 working days). how many items need to be counted each day?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 09:50, thanitoast84

Acar manufacturer uses new machines that automatically assemble an engine from parts fed to the system. the machine can regulate the speed ofassembly depending on the number of parts produced. which type of technology does this machine use? angenoem mense wat ons in matin en esta va ser elthe machine uses

Answers: 3

Business, 22.06.2019 23:00, dededese2403

Which of the following represents an unlimited queue? a. toll booth serving automobiles on the interstateb. drive through lane at a fast food restaurantc. faculty office with limited seating during office hoursd. restaurant with no outside seating and limited capacity due to fire departments restrictionse. small barbershop with only 5 chairs for waiting customers

Answers: 3

Business, 23.06.2019 00:10, Frenchfries13

Warren company plans to depreciate a new building using the double declining-balance depreciation method. the building cost $870,000. the estimated residual value of the building is $57,000 and it has an expected useful life of 20 years. assuming the first year's depreciation expense was recorded properly, what would be the amount of depreciation expense for the second year?

Answers: 2

Business, 23.06.2019 02:30, bitterswt01

The accountant at bramble corp. has determined that income before income taxes amounted to $10800 using the fifo costing assumption. if the income tax rate is 30% and the amount of income taxes paid would be $900 greater if the lifo assumption were used, what would be the amount of income before taxes under the lifo assumption?

Answers: 2

Do you know the correct answer?

Lindsay electronics, a small manufacturer of electronic research equipment, has approximately 6 comm...

Questions in other subjects:

Business, 21.11.2020 05:30

Mathematics, 21.11.2020 05:30

Business, 21.11.2020 05:30

History, 21.11.2020 05:30

Engineering, 21.11.2020 05:30

Health, 21.11.2020 05:30

Mathematics, 21.11.2020 05:30

Mathematics, 21.11.2020 05:30