Business, 30.11.2019 06:31, Tcareyoliver

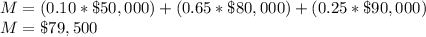

Acompany collects 25% of its sales during the month of sale, 65% one month after the sale, and 10% two months after the sale. the company expects sales of $50,000 in august, $80,000 in september, $90,000 in october, and $60,000 in november. how much money is expected to be collected in october? a. $22,500 b. $79,500 c. $90,000 d. $55,000

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 15:30, slonekaitlyn01

Kayla and jada are roommates in new york city. both kayla and jada recently received pay raises. kayla now buys more movie tickets than before, but jada buys fewer. kayla behaves as if movie tickets are goods and jada's income elasticity of demand for movie tickets is

Answers: 2

Business, 22.06.2019 22:40, tonypewitt

Johnson company uses the allowance method to account for uncollectible accounts receivable. bad debt expense is established as a percentage of credit sales. for 2018, net credit sales totaled $6,400,000, and the estimated bad debt percentage is 1.40%. the allowance for uncollectible accounts had a credit balance of $61,000 at the beginning of 2018 and $49,500, after adjusting entries, at the end of 2018.required: 1. what is bad debt expense for 2018 as a percent of net credit sales? 2. assume johnson makes no other adjustment of bad debt expense during 2018. determine the amount of accounts receivable written off during 2018.3. if the company uses the direct write-off method, what would bad debt expense be for 2018?

Answers: 1

Business, 23.06.2019 01:30, stranger123

At the end of the fiscal year, apha airlines has an outstanding non-cancellable purchase commitment for the purchase of 1 million gallons of jet fuel at a price of $4.10 per gallon for delivery during the coming summer. the company prices its inventory at the lower of cost or market. if the market price for jet fuel at the end of the year is $4.50, how would this situation be reflected in the annual financial statements?

Answers: 2

Business, 23.06.2019 03:00, vrw28

You are considering purchasing a company — assets, liabilities, warts, and all. you are aware that sometimes liabilities do not always show up on the balance sheet. discuss five examples of liabilities that may not be explicitly recognized on the balance sheet, making sure to explain why they are liabilities.

Answers: 1

Do you know the correct answer?

Acompany collects 25% of its sales during the month of sale, 65% one month after the sale, and 10% t...

Questions in other subjects:

Mathematics, 08.10.2019 21:00

Biology, 08.10.2019 21:00

History, 08.10.2019 21:00