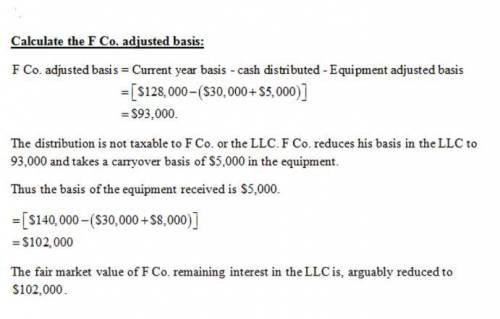

Franco owns a 60% interest in the dulera llc. on december 31 of the current tax year, his basis in the llc interest is $128,000. the fair market value of the interest is $140,000. in a proportinate nonliquidating distribution, the llc distributes $30,000 cash and equipment with an adjusted basis of $5,000 and a fair market value of $8,000 to him on that date. how much is franco's adjusted basis in the llc interest after the distribution and what is the amount of his basis in the equipment received?

Answers: 2

Similar questions

Business, 22.06.2019 02:50, dreyes439

Answers: 3

Business, 18.10.2019 23:00, igtguith

Answers: 1

Business, 16.11.2019 05:31, plewse

Answers: 3

Do you know the correct answer?

Franco owns a 60% interest in the dulera llc. on december 31 of the current tax year, his basis in t...

Questions in other subjects:

English, 25.01.2022 15:40

Mathematics, 25.01.2022 15:40

Social Studies, 25.01.2022 15:40

Mathematics, 25.01.2022 15:40

Mathematics, 25.01.2022 15:40

Mathematics, 25.01.2022 15:40

English, 25.01.2022 15:40