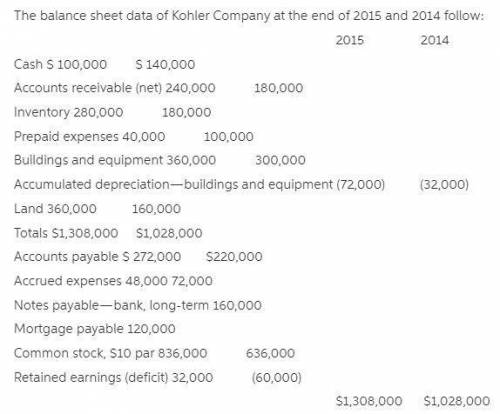

Land was acquired for $200,000 in exchange for common stock, par $200,000, during the year; all equipment purchased was for cash. equipment costing $20,000 was sold for $8,000; book value of the equipment was$16,000 and the loss was reported as an ordinary item in net income. cash dividends of $40,000 were charged to retained earnings and paid during the year; the transfer of net income to retained earnings was the only other entry in the retained earnings account. in the statement of cash flows for the year ended december 31,2015, for naley company: 1. the net cash provided by operating activities wasa) $104,000.b) $132,000.c) $112,000.d) $96,000.

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 14:00, RipoldSmellypoop47

Gibson's bodywork does automotive collision work. an insurance agency has determined that the standard time to replace a fender is 2.5 hours (i. e., "standard output" 0.4

Answers: 2

Business, 22.06.2019 02:20, gabegabemm1

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 14:30, kaylahill14211

You hear your supervisor tell another supervisor that a fire drill will take place later today when the fire alarm sounds that afternoon you should

Answers: 1

Business, 22.06.2019 17:00, justyne2004

Afinancing project has an initial cash inflow of $42,000 and cash flows of −$15,600, −$22,200, and −$18,000 for years 1 to 3, respectively. the required rate of return is 13 percent. what is the internal rate of return? should the project be accepted?

Answers: 1

Do you know the correct answer?

Land was acquired for $200,000 in exchange for common stock, par $200,000, during the year; all equ...

Questions in other subjects:

Mathematics, 04.06.2020 20:05

Mathematics, 04.06.2020 20:05

Chemistry, 04.06.2020 20:05

Mathematics, 04.06.2020 20:05