Business, 30.11.2019 02:31, angellong94

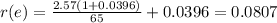

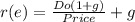

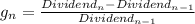

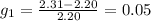

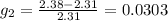

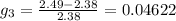

Suppose stark ltd. just issued a dividend of $2.57 per share on its common stock. the company paid dividends of $2.20, $2.31, $2.38, and $2.49 per share in the last four years.

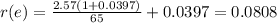

1) if the stock currently sells for $65, what is your best estimate of the company’s cost of equity capital using the arithmetic average growth rate in dividends?

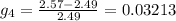

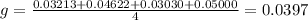

2) what if you use the geometric average growth rate?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 11:30, Coltong121

Buyer henry is going to accept seller shannon's $282,500 counteroffer. when will this counteroffer become a contract. a. counteroffers cannot become contracts b. when henry gives shannon notice of the acceptance c. when henry signs the counteroffer d. when shannon first made the counteroffer

Answers: 3

Business, 22.06.2019 11:50, 2kdragginppl

Stocks a, b, and c are similar in some respects: each has an expected return of 10% and a standard deviation of 25%. stocks a and b have returns that are independent of one another; i. e., their correlation coefficient, r, equals zero. stocks a and c have returns that are negatively correlated with one another; i. e., r is less than 0. portfolio ab is a portfolio with half of its money invested in stock a and half in stock b. portfolio ac is a portfolio with half of its money invested in stock a and half invested in stock c. which of the following statements is correct? a. portfolio ab has a standard deviation that is greater than 25%.b. portfolio ac has an expected return that is less than 10%.c. portfolio ac has a standard deviation that is less than 25%.d. portfolio ab has a standard deviation that is equal to 25%.e. portfolio ac has an expected return that is greater than 25%.

Answers: 3

Business, 22.06.2019 17:20, sctenk6052

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Do you know the correct answer?

Suppose stark ltd. just issued a dividend of $2.57 per share on its common stock. the company paid d...

Questions in other subjects:

Biology, 02.12.2019 00:31

Health, 02.12.2019 00:31

Mathematics, 02.12.2019 00:31

Mathematics, 02.12.2019 00:31

Biology, 02.12.2019 00:31

History, 02.12.2019 00:31

![g=\sqrt[n]{(1+g_{1} )(1+g_{2} )(1+g_{3} )...(1+g_{n} )}](/tpl/images/0396/6527/89488.png)

![g=\sqrt[4]{(1+0.03213 )(1+0.04622 )(1+0.0303 )(1+0.0500 )} =0.0396](/tpl/images/0396/6527/a40e9.png)