Business, 30.11.2019 02:31, halobry2003

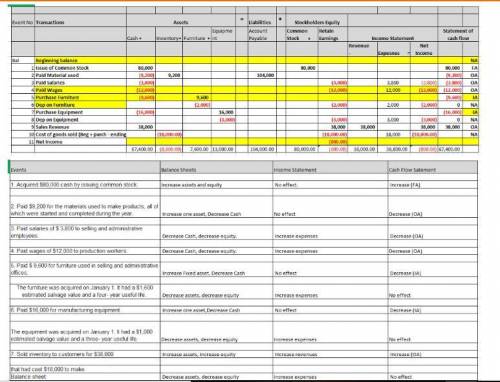

Gunn manufacturing company experienced the following accounting events during its first year of operation. with the exception of the adjusting entries for depreciation, assume that all transactions are cash transactions.

1. acquired $80,000 cash by issuing common stock.

2. paid $9,200 for the materials used to make its products, all of which were started and completed during the year.

3. paid salaries of $3,800 to selling and administrative employees.

4. paid wages of $12,000 to production workers.

5. paid $9,600 for furniture used in selling and administrative offices. the furniture was acquired on january 1. it had a $1,600 estimated salvage value and a four-year useful life.

6. paid $16,000 for manufacturing equipment. the equipment was acquired on january 1. it had a $1,000 estimated salvage value and a five-year useful life.

7. sold inventory to customers for $38,000 that had cost $18,000 to make.

required:

show how these events would affect the balance sheet, income statement, and statement of cash flows by recording them in a horizontal financial statements model as indicated here. also, in the cash flow column, indicate whether the cash flow is for operating activities (oa), investing activities (ia), or financing activities (fa). use na to indicate that an element is not affected by the event. the first event is recorded as an example. (enter any decreases to account balances and cash outflows with a minus sign.)

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 06:30, mjasmine3280

The larger the investment you make, the easier it will be to: get money from other sources. guarantee cash flow. buy insurance. streamline your products.

Answers: 3

Business, 22.06.2019 08:40, jade468

Examine the following book-value balance sheet for university products inc. the preferred stock currently sells for $30 per share and pays a dividend of $3 a share. the common stock sells for $16 per share and has a beta of 0.9. there are 2 million common shares outstanding. the market risk premium is 9%, the risk-free rate is 5%, and the firm’s tax rate is 40%. book-value balance sheet (figures in $ millions) assets liabilities and net worth cash and short-term securities $ 2.0 bonds, coupon = 6%, paid annually (maturity = 10 years, current yield to maturity = 8%) $ 5.0 accounts receivable 3.0 preferred stock (par value $15 per share) 3.0 inventories 7.0 common stock (par value $0.20) 0.4 plant and equipment 21.0 additional paid-in stockholders’ equity 13.6 retained earnings 11.0 total $ 33.0 total $ 33.0 a. what is the market debt-to-value ratio of the firm? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. what is university’s wacc? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 3

Business, 22.06.2019 11:20, jaideeplalli302

You decided to charge $100 for your new computer game, but people are not buying it. what could you do to encourage people to buy your game?

Answers: 1

Business, 22.06.2019 11:40, berlyntyler

Select the correct answer brian wants to add a chart to his dtp project. what is the best way he can do this? a draw the chart using the dtp program draw option b create the chart in a spreadsheet then import it c. use the dtp chart wizard to create the chart within the dtp d. create an image of the chart in an image editor then import the image e use html code to create a chart within the dtp program

Answers: 3

Do you know the correct answer?

Gunn manufacturing company experienced the following accounting events during its first year of oper...

Questions in other subjects:

History, 27.01.2020 11:31

Social Studies, 27.01.2020 11:31

English, 27.01.2020 11:31