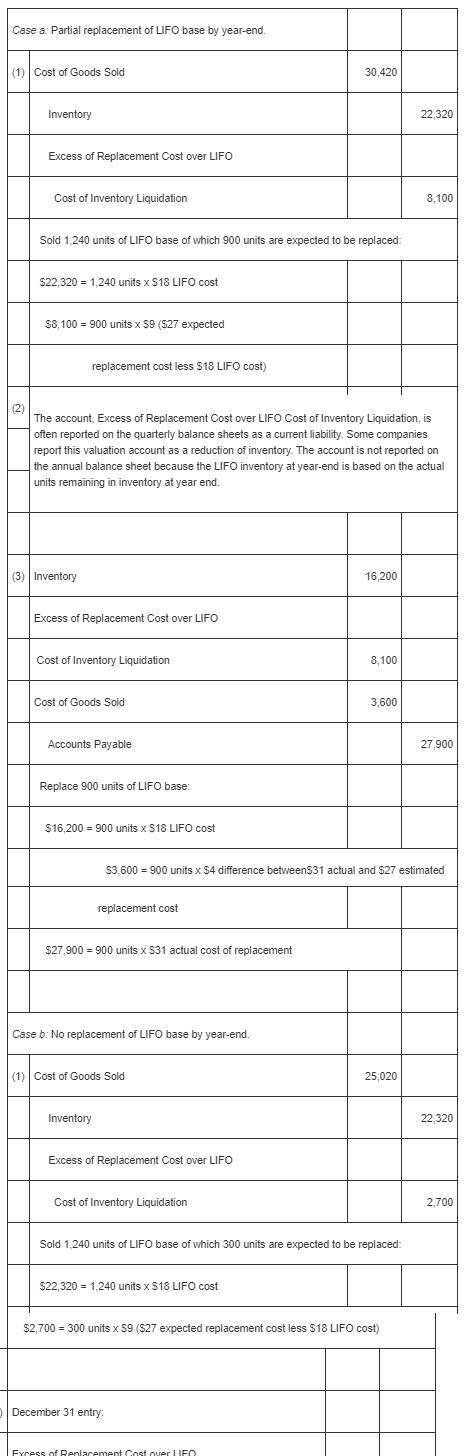

Lifo liquidationduring july, laesch company, which uses a perpetual inventory system, sold 1,240 units from its lifo-based inventory. which had originally cost 518 per unit. the replacement cost is expected to be $27 per unit. respond to the following two independent scenarios as requested. a. case 1: in july, the company is planning to reduce its inventory and expects to replace only 900 of these units bydecember 31, the end of its fiscal year.(1) prepare the entry in july to record the sale of the 1,240 units.(2] discuss the proper financial statement presentation of the valuation account related to the 1,240 units sold.(3) prepare the entry for the replacement of the 900 units in september at an actual cost of $31 per unit. b. case2~ in july, the company is planning to reduce its inventory and expects to replace only300 of its units by december 31, the end of its fiscal year.(1) prepare the entry in july to record the sale of the 1,240 units.(2] in december, the company decided not to replace any of the 1,240 units. prepare the entry required on december 31 toeliminate any valuation accounts related to the inventory that will not be replaced.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 00:00, josiesolomonn1605

Which statement about the cost of the options is true? she would save $1,000 by choosing option b. she would save $5,650 by choosing option a. she would save $11,200 by choosing option b. she would save $11,300 by choosing option a.

Answers: 2

Business, 22.06.2019 20:00, pickelswolf3036

On january 1, year 1, purl corp. purchased as a long-term investment $500,000 face amount of shaw, inc.’s 8% bonds for $456,200. the bonds were purchased to yield 10% interest. the bonds mature on january 1, year 6, and pay interest annually on january 1. purl uses the effective interest method of amortization. what amount (rounded to nearest $100) should purl report on its december 31, year 2, balance sheet for these held-to-maturity bonds?

Answers: 1

Business, 22.06.2019 23:40, xrenay

Four key marketing decision variables are price (p), advertising (a), transportation (t), and product quality (q). consumer demand (d) is influenced by these variables. the simplest model for describing demand in terms of these variables is: d = k – pp + aa + tt + qq where k, p, a, t, and q are constants. discuss the assumptions of this model. specifically, how does each variable affect demand? how do the variables influence each other? what limitations might this model have? how can it be improved?

Answers: 2

Business, 23.06.2019 00:10, Easton777

Wang distributors has an annual demand for an airport metal detector of 1 comma 350 units. the cost of a typical detector to wang is $400. carrying cost is estimated to be 19% of the unit cost, and the ordering cost is $24 per order. if ping wang, the owner, orders in quantities of 300 or more, he can get a 10% discount on the cost of the detectors. should wang take the quantity discount? \

Answers: 1

Do you know the correct answer?

Lifo liquidationduring july, laesch company, which uses a perpetual inventory system, sold 1,240 uni...

Questions in other subjects:

Mathematics, 03.12.2020 19:40

Mathematics, 03.12.2020 19:40

Chemistry, 03.12.2020 19:40

Biology, 03.12.2020 19:40