Business, 28.11.2019 03:31, 4804341040

Fuqua company's sales budget projects unit sales of part 198z of 10,000 units in january, 12,000 units in february, and 13,000 units in march. each unit of part 198z requires 4 pounds of materials, which cost $2 per pound. fuqua company desires its ending raw materials inventory to equal 40% of the next month's production requirements, and its ending finished goods inventory to equal 20% of the next month's expected unit sales. these goals were met at december 31, 2016.

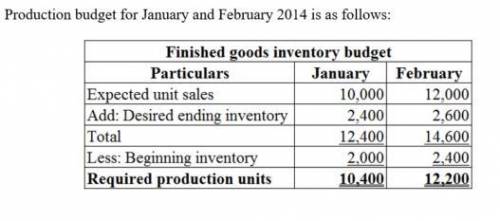

the production budget for january and february 2017 follow:

fuqua company

production budget

for the two months ending february 28, 2017

january february

expected units sales 10,000 12,000

add: desired ending finished goods inventory 2,400 2,600

total required units 12,400 14,600

less: beginning finished goods inventory 2,000 2,400

required production units 10,400 12,200

prepare a direct materials budget for january 2017.

fuqua company

direct materials budget

for the month ending january 31, 2017

january

units to be produced 10,400

direct material pounds per unit 4

total pounds needed for production 41,600

add: desired pounds in ending materials inventory

total materials required

less: beginning direct materials

direct materials purchases

cost per pound $2

total cost of direct materials purchased

direct materials budget:

budgets are used by companies for planning purposes and for comparison purposes after to see how their expectations compare to what they actually spent. a direct materials budget is used to predict how much direct materials will need to be purchased and what the predicted cost will be.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:10, Derienw6586

Walsh company manufactures and sells one product. the following information pertains to each of the company’s first two years of operations: variable costs per unit: manufacturing: direct materials $ 25 direct labor $ 12 variable manufacturing overhead $ 5 variable selling and administrative $ 4 fixed costs per year: fixed manufacturing overhead $ 400,000 fixed selling and administrative expenses $ 60,000 during its first year of operations, walsh produced 50,000 units and sold 40,000 units. during its second year of operations, it produced 40,000 units and sold 50,000 units. the selling price of the company’s product is $83 per unit. required: 1. assume the company uses variable costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 2. assume the company uses absorption costing: a. compute the unit product cost for year 1 and year 2. b. prepare an income statement for year 1 and year 2. 3. reconcile the difference between variable costing and absorption costing net operating income in year 1.

Answers: 3

Business, 22.06.2019 11:00, roseemariehunter12

In each of the following cases, find the unknown variable. ignore taxes. (do not round intermediate calculations and round your answers to the nearest whole number, e. g., 32.) accounting unit price unit variable cost fixed costs depreciation break-even 20,500 $ 44 $ 24 $ 275,000 $ 133,500 44 4,400,000 940,000 8,000 75 320,000 80,000

Answers: 3

Business, 22.06.2019 12:30, chycooper101

Rossdale co. stock currently sells for $68.91 per share and has a beta of 0.88. the market risk premium is 7.10 percent and the risk-free rate is 2.91 percent annually. the company just paid a dividend of $3.57 per share, which it has pledged to increase at an annual rate of 3.25 percent indefinitely. what is your best estimate of the company's cost of equity?

Answers: 1

Business, 22.06.2019 20:00, LJ710

Miller mfg. is analyzing a proposed project. the company expects to sell 14,300 units, plus or minus 3 percent. the expected variable cost per unit is $15 and the expected fixed cost is $35,000. the fixed and variable cost estimates are considered accurate within a plus or minus 3 percent range. the depreciation expense is $32,000. the tax rate is 34 percent. the sale price is estimated at $19 a unit, give or take 3 percent. what is the net income under the worst case scenario?

Answers: 2

Do you know the correct answer?

Fuqua company's sales budget projects unit sales of part 198z of 10,000 units in january, 12,000 uni...

Questions in other subjects:

Biology, 27.10.2020 20:10

Mathematics, 27.10.2020 20:10

English, 27.10.2020 20:10

English, 27.10.2020 20:10

English, 27.10.2020 20:10

English, 27.10.2020 20:10

Geography, 27.10.2020 20:10