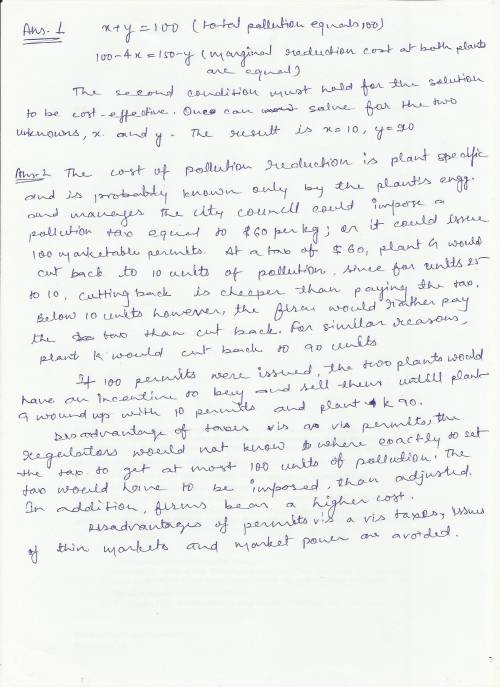

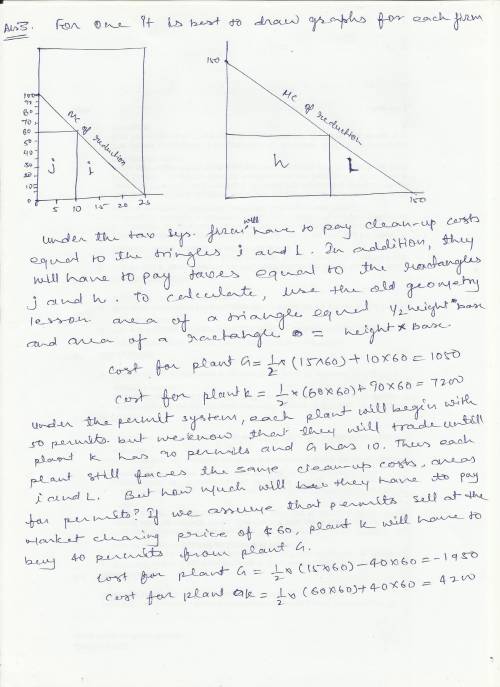

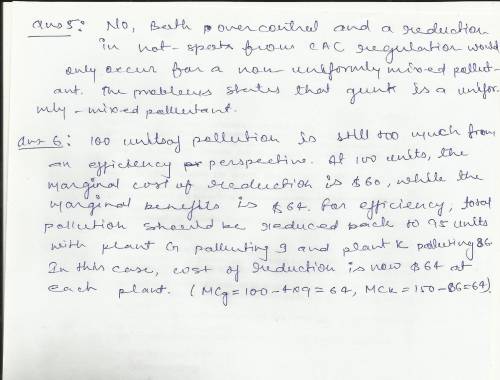

Two plants are emitting a uniformly mixed pollutant called gunk into the beautiful sky over tourist town. the city government decides it can tolerate total emissions of no more than 100 kg of gunk per day. plant g has marginal reduction costs of 100 - 4x and is currently polluting at a level of 25, while plant k has marginal reduction costs of 150 - y and currently pollutes at a level of 150 (x and y are the level of emissions at each plant).

1. what is the cost-effective pollution level for each plant if total pollution must equal 100? suppose the city government knows marginal reduction costs at the two plants. in this case, could the city obtain cost-effective pollution reduction using a cac approach? if so, how?

2. in reality, why might the city have a hard time getting this information?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:40, Josias13

In early january, burger mania acquired 100% of the common stock of the crispy taco restaurant chain. the purchase price allocation included the following items: $4 million, patent; $3 million, trademark considered to have an indefinite useful life; and $5 million, goodwill. burger mania's policy is to amortize intangible assets with finite useful lives using the straight-line method, no residual value, and a five-year service life. what is the total amount of amortization expense that would appear in burger mania's income statement for the first year ended december 31 related to these items?

Answers: 2

Business, 23.06.2019 02:00, 20jmurphy82

One country has a comparative advantage over another country in the production of a good if ithas a curved production possibilities curve and the other country has a linear production possibilities curve. has lower fixed costs than the other country. has a linear production possibilities curve and the other country has a curved production possibilities curve. is a lower opportunity cost producer of the good.

Answers: 1

Business, 23.06.2019 07:50, zitterkoph

Your company is starting a new r& d initiative: a development of a new drug that dramatically reduces the addiction to smoking. the expert team estimates the probability of developing the drug succesfully at 60% and a chance of losing the investment of 40%. if the project is successful, your company would earn profits (after deducting the investment) of 9,000 (thousand usd). if the development is unsuccessful, the whole investment will be lost -1,000 (thousand usd). your company's risk preference is given by the expected utility function: u(x) v1000 +x, where x is the monetary outcome of a project. calculate the expected profit of the project . calculate the expected utility of the project . find the certainty equivalent of this r& d initiative . find the risk premium of this r& d initiative e is the company risk-averse, risk-loving or risk-neutral? why do you think so?

Answers: 3

Do you know the correct answer?

Two plants are emitting a uniformly mixed pollutant called gunk into the beautiful sky over tourist...

Questions in other subjects:

English, 04.08.2019 20:20

Spanish, 04.08.2019 20:20

English, 04.08.2019 20:20

Chemistry, 04.08.2019 20:20

English, 04.08.2019 20:20

History, 04.08.2019 20:20

History, 04.08.2019 20:20

Mathematics, 04.08.2019 20:20

English, 04.08.2019 20:20