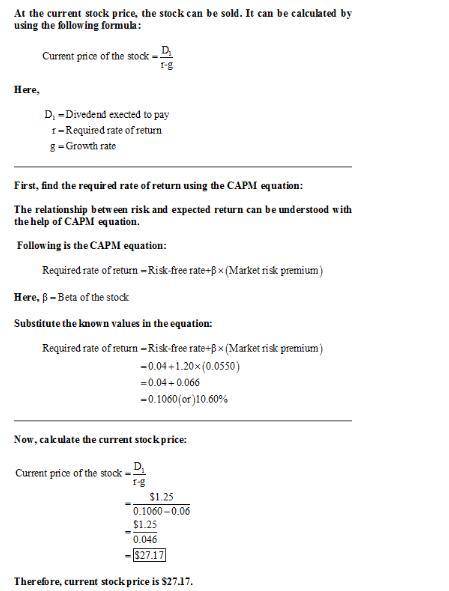

The francis company is expected to pay a dividend of d1 = $1.25 per share at the end of the year, and that dividend is expected to grow at a constant rate of 6.00% per year in the future. the company's beta is 1.70, the market risk premium is 5.50%, and the risk-free rate is 4.00%. what is the company's current stock price? do not round intermediate calculations.

Answers: 3

Other questions on the subject: Business

Business, 23.06.2019 02:50, trejoste1

Three years ago, stock tek purchased some five-year macrs property for $82,600. today, it is selling this property for $31,500. how much tax will the company owe on this sale if the tax rate is 34 percent? the macrs allowance percentages are as follows, commencing with year 1: 20.00, 32.00, 19.20, 11.52, 11.52, and 5.76 percent.

Answers: 1

Business, 23.06.2019 10:20, cheesecake1919

Teatro restoration, inc., begins renovating an old theater for urban edge productions, but after three months teatro demands an extra $250,000. urban edge agrees to pay. refer to fact pattern 13–4. if teatro says it is asking for the extra $250,000 because it has encountered extraordinary unforeseen difficulties that will add considerable cost to the project, the agreement is

Answers: 3

Business, 23.06.2019 11:00, coreyslotte

Stacy is preparing a product presentation with customer, marketing, and technical content. she will first present it to an engineering audience mainly interested in technical product details. what should she do? select the best option. hide the marketing content slides for the engineering audience. save a new version and delete unwanted slides for this audience. cut and paste all the unwanted slides to the end. create a custom slide show for multiple audiences.

Answers: 3

Do you know the correct answer?

The francis company is expected to pay a dividend of d1 = $1.25 per share at the end of the year, an...

Questions in other subjects:

Mathematics, 29.05.2020 06:58

History, 29.05.2020 06:58

Mathematics, 29.05.2020 06:59

Mathematics, 29.05.2020 06:59

Mathematics, 29.05.2020 06:59