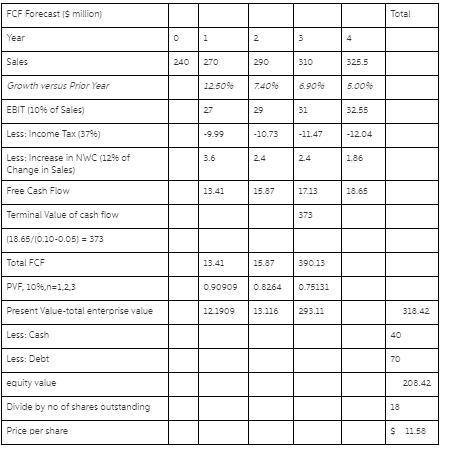

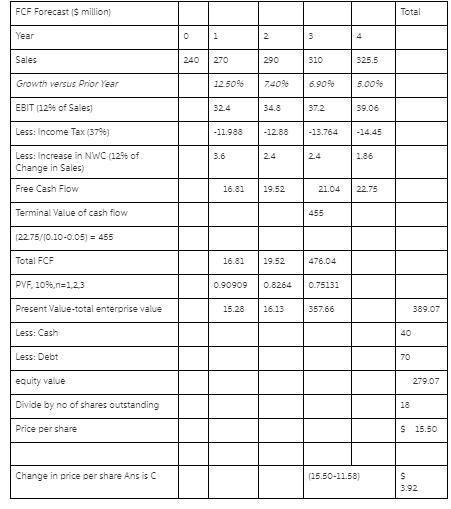

Banco industries expect sales to grow at a rapid rate over the next three years, but settle to anindustry growth rate of 5% in year 4. the spreadsheet above shows a simplified pro forma forbanco industries. if banco industries has a weighted average cost of capital of 11%, $50 millionin cash, $80 million in debt, and 18 million shares outstanding, which of the following is the bestestimate of bancoʹs stock price at the start of year 1? a) $6.52b) $11.74c) $13.04d) $23.48

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 06:30, Shavaila18

Select all that apply. what do opponents of minimum wage believe are the results of minimum wage? increases personal income results in job shortages causes unemployment raises prices of goods

Answers: 1

Business, 22.06.2019 09:40, cerna

Alpha industries is considering a project with an initial cost of $8 million. the project will produce cash inflows of $1.49 million per year for 8 years. the project has the same risk as the firm. the firm has a pretax cost of debt of 5.61 percent and a cost of equity of 11.27 percent. the debt–equity ratio is .60 and the tax rate is 35 percent. what is the net present value of the project?

Answers: 1

Business, 22.06.2019 14:30, ayoismeisjjjjuan

Amethod of allocating merchandise cost that assumes the first merchandise bought was the first merchandise sold is called the a. last-in, first-out method. b. first-in, first-out method. c. specific identification method. d. average cost method.

Answers: 3

Do you know the correct answer?

Banco industries expect sales to grow at a rapid rate over the next three years, but settle to anind...

Questions in other subjects:

Mathematics, 02.07.2019 14:00

Social Studies, 02.07.2019 14:00

Mathematics, 02.07.2019 14:00

Chemistry, 02.07.2019 14:00

Mathematics, 02.07.2019 14:00