Business, 27.11.2019 00:31, QueenNerdy889

Initially, three firms a, b, and c share the market for a certain commodity. firm a has 30% of the market, firm b has 45%, and c has 25%. each year, the following changes occur:

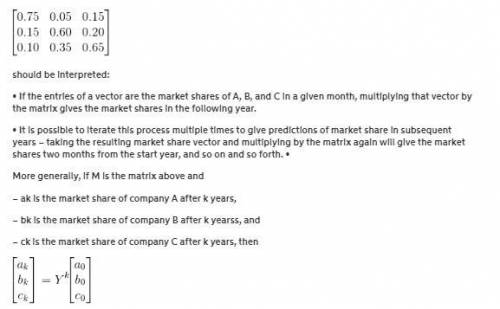

• a keeps 75% of its customers, while losing 15% to b and 10% to c.

• b keeps 60% of its customers, while losing 5% to a and 35% to c.

• c keeps 65% of its customers, while losing 15% to a and 20% to b.

(a) what is the current market share vector (ordered for a, b, and c)?

(b) find the transition matrix for this scenario.

(c) find the share of the market that each company has after two years.

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 00:50, emma3216

cranium, inc., purchases term papers from an overseas supplier under a continuous review system. the average demand for a popular mode is 300 units a day with a standard deviation of 30 units a day. it costs $60 to process each order and there is a five−day lead−time. the holding cost for a paper is $0.25 per year and the company policy is to maintain a 98% service level. cranium operates 200 days per year. what is the reorder point r to satisfy a 98% cycleminus−service level? a. greater than 1,700 unitsb. greater than 1,600 units but less than or equal to 1,700 unitsc. greater than 1,500 units but less than or equal to 1,600 unitsd. less than or equal to 1,500 units

Answers: 1

Business, 22.06.2019 21:30, dondre54

The year-end financial statements of calloway company contained the following elements and corresponding amounts: assets = $34,000; liabilities = ? ; common stock = $6,400; revenue = $13,800; dividends = $1,450; beginning retained earnings = $4,450; ending retained earnings = $8,400. based on this information, the amount of expenses on calloway's income statement was

Answers: 1

Business, 23.06.2019 00:00, rozalee14

Which of the following statements is correct? a major disadvantage of a partnership relative to a corporation is the fact that federal income taxes must be paid by the partners rather than by the firm itself. in a typical partnership, liability for other partners’ misdeeds is limited to the amount of a particular partner’s investment in the business. true in a limited partnership, the limited partners have voting control, while the general partner has operating control over the business, and the limited partners are individually responsible, on a pro rata basis, for the firm’s debts in the event of bankruptcy. partnerships have more difficulty attracting large amounts of capital than corporations because of such factors as unlimited liability, the need to reorganize when a partner dies, and the illiquidity of partnership interests.

Answers: 1

Do you know the correct answer?

Initially, three firms a, b, and c share the market for a certain commodity. firm a has 30% of the m...

Questions in other subjects:

History, 29.08.2020 21:01

Mathematics, 29.08.2020 21:01

History, 29.08.2020 21:01

Business, 29.08.2020 21:01