Business, 26.11.2019 05:31, jholland03

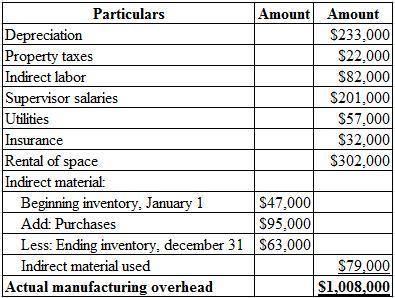

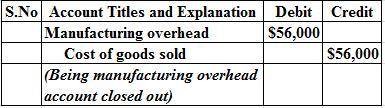

Calculate the overapplied or underapplied overhead for the year and prepare a journal entry to close out the manufacturing overhead account into cost of goods soldthe following information pertains to paramus metal works for the year just ended. budgeted direct-labor cost: 75,000 hours (practical capacity) at $16 per hour actual direct-labor cost: 80,000 hours at $17.50 per hour budgeted manufacturing overhead: $997,500budgeted selling and administrative expenses: $435,000actual manufacturing overhead: depreciation $ 233,000 property taxes 22,000 indirect labor 82,000 supervisory salaries 201,000 utilities 57,000 insurance 32,000 rental of space 302,000 indirect material (see data below) 79,000 indirect material: beginning inventory, january 1 47,000 purchases during the year 95,000 ending inventory, december 31 63,000 i calculated the cost driver is 13.30 , can someone me with the following-1. calculate the overapplied or underapplied overhead for the yea2.prepare a journal entry to close out the manufacturing overhead account into cost of goods sold

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 19:10, jonmorton159

The stock of grommet corporation, a u. s. company, is publicly traded, with no single shareholder owning more than 5 percent of its outstanding stock. grommet owns 95 percent of the outstanding stock of staple inc., also a u. s. company. staple owns 100 percent of the outstanding stock of clip corporation, a canadian company. grommet and clip each own 50 percent of the outstanding stock of fastener inc., a u. s. company. grommet and staple each own 50 percent of the outstanding stock of binder corporation, a u. s. company. which of these corporations form an affiliated group eligible to file a consolidated tax return?

Answers: 3

Business, 23.06.2019 02:10, Thejollyhellhound20

Make or buy eastside company incurs a total cost of $120,000 in producing 10,000 units of a component needed in the assembly of its major product. the component can be purchased from an outside supplier for $11 per unit. a related cost study indicates that the total cost of the component includes fixed costs equal to 50% of the variable costs involved. a. should eastside buy the component if it cannot otherwise use the released capacity? present your answer in the form of differential analysis. use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers. cost from outside supplier $answer variable costs avoided by purchasing answer net advantage (disadvantage) to purchase alternative $answer b. what would be your answer to requirement (a) if the released capacity could be used in a project that would generate $50,000 of contribution margin? use negative sign represent a net disadvantage answer; otherwise do not use negative signs with your answers.

Answers: 2

Business, 23.06.2019 02:20, mpgleboski

When the benefit of one particular use of a resource is greater than the opportunity cost, then that resource is which of the following? a. not scarce b. being used efficiently c. a normal good d. non-excludable

Answers: 2

Business, 23.06.2019 13:00, yayamcneal05

How should the financial interests of stockholders be balanced with varied interests of stakeholders? if you were writing a code of conduct for your company, how would you address this issue?

Answers: 2

Do you know the correct answer?

Calculate the overapplied or underapplied overhead for the year and prepare a journal entry to close...

Questions in other subjects:

English, 01.04.2021 16:30

Biology, 01.04.2021 16:30

Spanish, 01.04.2021 16:30

Social Studies, 01.04.2021 16:30