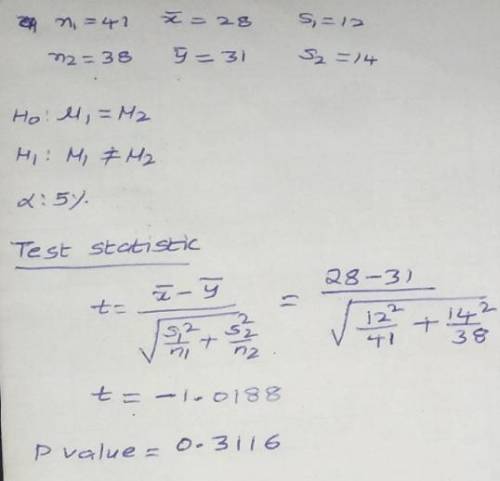

Is there a difference in the average donation given in presbyterian vs catholic church on sundays? the 41 randomly selected members of the presbyterian church donated an average of $28 with a standard deviation of $12. the 38 randomly selected members of the catholic church donated an average of $31 with a standard deviation of $14. what can be concluded at the 0.05 level of significance?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 13:40, nina1390

Determine if the following statements are true or false. an increase in government spending can crowd out private investment. an improvement in the budget balance increases the demand for financial capital. an increase in private consumption may crowd out private investment. lower interest rates can lead to private investment being crowded out. a trade balance in sur+ increases the supply of financial capital. if private savings is equal to private investment, then there is neither a budget sur+ nor a budget deficit.

Answers: 1

Business, 23.06.2019 07:00, brokegirlyy

Rare beef roasts can be cooked to what internal temperature? a) 120°f b) 130°f c) 145°f d) 155°f

Answers: 1

Business, 23.06.2019 17:00, maybrieldridge12

Tom and carol are resident aliens, married, and want to file a joint return. they have two children. sydney is 5 years old and a resident alien. benjamin is 2 years old and a u. s. citizen. both children lived with the parents in the united states all year. tom, carol, and sydney have individual taxpayer identification numbers (itins). benjamin has a social security number. tom earned $30,000 in wages. carol had $8,000 in wage income. they had no other income. tom and carol provided all the support for sydney and benjamin. sydney and benjamin attended daycare while tom and carol were at work. tom and carol did not receive dependent care benefits from a dependent care benefits plan or flexible spending account. the daycare center provided the baker's with a statement indicating the amount of $3,250 paid for 2018, their name, address and valid employer identification number. 6. who can tom and carol claim as a qualifying child for the child tax credit? a. sydney b. benjamin c. both sydney and benjamin d. neither sydney or benjamin

Answers: 2

Do you know the correct answer?

Is there a difference in the average donation given in presbyterian vs catholic church on sundays?...

Questions in other subjects:

Mathematics, 15.10.2020 20:01

Mathematics, 15.10.2020 20:01

Mathematics, 15.10.2020 20:01

Chemistry, 15.10.2020 20:01