Business, 26.11.2019 02:31, isaiahhuettnerowgg8d

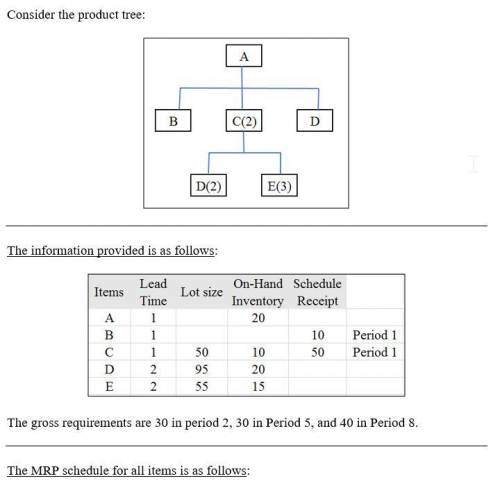

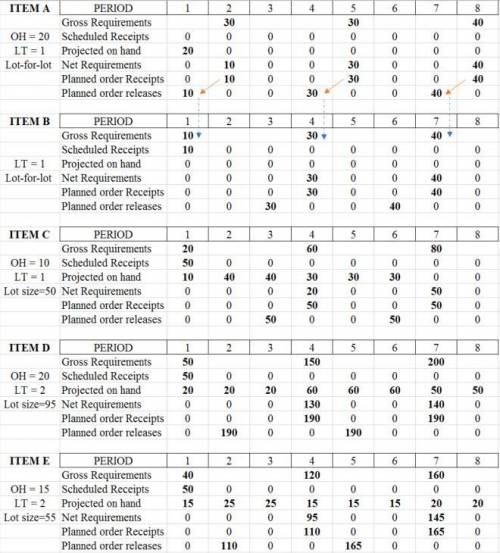

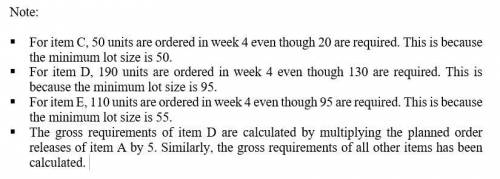

Each unit of a is composed of one unit of b, two units of c, and one unit of d. c is composed of two units of d and three units of e. items a, c, d, and e have on-hand inventories of 20, 10, 20, and 15 units, respectively. item b has a scheduled receipt of 10 units in period 1, and c has a scheduled receipt of 50 units in period 1. lot-for-lot (l4l) is used for items a and b. item c requires a minimum lot size of 50 units. d and e are required to be purchased in multiples of 95 and 55, respectively. lead times are one period for items a, b, and c, and two periods for items d and e. the gross requirements for a are 30 in period 2, 30 in period 5, and 40 in period 8. note: to simplify data handling to include the receipt of orders that have actually been placed in previous periods, the following five-level scheme can be used. (a number of different techniques are used in practice, but the important issue is to keep track of what is on hand, what is expected to arrive, what is needed, and what size orders should be placed.) find the planned order releases for all items. (leave no cells blank - be certain to enter "0" wherever required.) period 1 2 3 4 5 6 7 8 item a oh = 20 lt = 1 ss = 0 q = l4l gross requirements scheduled receipts projected available balance net requirements planned order receipts planned order releases item b oh = 0 lt = 1 ss = 0 q = l4l gross requirements scheduled receipts projected available balance net requirements planned order receipts planned order releases item c oh = 10 lt = 1 ss = 0 q = 50 gross requirements scheduled receipts projected available balance net requirements planned order receipts planned order releases item d oh = 20 lt = 2 ss = 0 q = 95 gross requirements scheduled receipts projected available balance net requirements planned order receipts planned order releases item e oh = 15 lt = 2 ss = 0 q = 55 gross requirements scheduled receipts projected available balance net requirements planned order receipts planned order releases

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 11:30, glowbaby123

Consider derek's budget information: materials to be used totals $64,750; direct labor totals $198,400; factory overhead totals $394,800; work in process inventory january 1, $189,100; and work in progress inventory on december 31, $197,600. what is the budgeted cost of goods manufactured for the year? a. $1,044,650 b. $649,450 c. $657,950 d. $197,600

Answers: 3

Business, 22.06.2019 17:40, briannagiddens

Adamson company manufactures four lines of garden tools. as a result of an activity analysis, the accounting department has identified eight activity cost pools. each of the product lines is produced in large batches, with the whole plant devoted to one product at a time. classify each of the following activities or costs as either unit-level, batch-level, product-level, or facility-level. activities (a) machining parts. (b) product design. (c) plant maintenance. (d) machine setup. (e) assembling parts. (f) purchasing raw materials. (g) property taxes. (h) painting.

Answers: 2

Business, 22.06.2019 23:30, breezer20042

How does the federal reserve stabilize and safeguard the nation’s economy? (select all that apply.) it distributes currency and oversees fiscal conditions. it implements american monetary policy. it regulates banks and defends consumer credit rights. it regulates and oversees the nasdaq stock exchange.

Answers: 1

Business, 23.06.2019 00:30, genyjoannerubiera

Listed below are several transactions that took place during the first two years of operations for the law firm of pete, pete, and roy. year 1 year 2amounts billed to clients for services rendered $ 170,000 $ 220,000 cash collected from clients 160,000 190,000 cash disbursements salaries paid to employees for services rendered during the year 90,000 100,000 utilities 30,000 40,000 purchase of insurance policy 60,000 0 in addition, you learn that the company incurred utility costs of $35,000 in year 1, that there were no liabilities at the end of year 2, no anticipated bad debts on receivables, and that the insurance policy covers a three-year period. required: 1. & 3. calculate the net operating cash flow for years 1 and 2 and determine the amount of receivables from clients that the company would show in its year 1 and year 2 balance sheets prepared according to the accrual accounting model.2. prepare an income statement for each year according to the accrual accounting model.

Answers: 1

Do you know the correct answer?

Each unit of a is composed of one unit of b, two units of c, and one unit of d. c is composed of two...

Questions in other subjects:

History, 18.08.2019 01:20

Health, 18.08.2019 01:20

Health, 18.08.2019 01:20