Business, 23.11.2019 02:31, alexalvarez304

For which capital component must you make a tax adjustment when calculating a firm’s weighted average cost of capital (wacc)?

a. debt

b. equity

c. preferred stock

omni consumer products company (ocp) can borrow funds at an interest rate of 12.50% for a period of seven years. its marginal federal-plus-state tax rate is 30%. ocp’s after-tax cost of debt is (rounded to two decimal places).

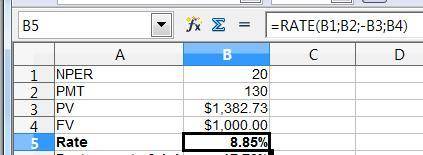

at the present time, omni consumer products company (ocp) has 20-year noncallable bonds with a face value of $1,000 that are outstanding. these bonds have a current market price of $1,382.73 per bond, carry a coupon rate of 13%, and distribute annual coupon payments. the company incurs a federal-plus-state tax rate of 30%. if ocp wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? (note: round your ytm rate to two decimal place.)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:30, batmanmarie2004

The card shoppe needs to maintain 21 percent of its sales in net working capital. currently, the store is considering a four-year project that will increase sales from its current level of $349,000 to $408,000 the first year and to $414,000 a year for the following three years of the project. what amount should be included in the project analysis for net working capital in year 4 of the project?

Answers: 3

Business, 22.06.2019 10:30, drejones338p04p2p

How are interest rates calculated by financial institutions? financial institutions generally calculate interest as (1) interest or (.

Answers: 1

Business, 22.06.2019 14:30, crystalryan3797

What’s the present value of a perpetuity that pays $250 per year if the appropriate interest rate is 5%? $4,750 $5,000 $5,250 $5,513 $5,788what is the present value of the following cash flow stream at a rate of 8.0%, rounded to the nearest dollar? cash flows: today (t = 0) it is $750, after one year (t = 1) it is $2,450, at t = 2 it is $3,175, and at t=3 it is $4,400. draw a time line. $7,917 $8,333 $8,772 $9,233 $9,695

Answers: 2

Business, 22.06.2019 23:10, jayjayw64

Tony prince is the project manager for the recreation and wellness intranet project. team members include you, a programmer/analyst and aspiring project manager; patrick, a network specialist; nancy, a business analyst; and bonnie, another programmer/analyst. other people are supporting the project from other departments, including yusaff from human resources and cassandra from finance. assume that these are the only people who can be assigned and charged to work on project activities. recall that your schedule and cost goals are to complete the project in six months for under $200,000.task 2identify at least eight milestones for the recreation and wellness intranet project. write a short paper describing each milestone using the smart criteria. discuss how determining these milestones might add activities or tasks to the gantt chart. remember that milestones normally have no duration, so you must have tasks that will lead to completing the milestone.

Answers: 3

Do you know the correct answer?

For which capital component must you make a tax adjustment when calculating a firm’s weighted averag...

Questions in other subjects:

Mathematics, 10.02.2021 14:00

Computers and Technology, 10.02.2021 14:00

History, 10.02.2021 14:00

Computers and Technology, 10.02.2021 14:00

Mathematics, 10.02.2021 14:00

Mathematics, 10.02.2021 14:00