Business, 23.11.2019 00:31, michellen2020

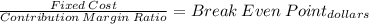

Midlands inc. had a bad year in 2016. for the first time in its history, it operated at a loss. the company’s income statement showed the following results from selling 77,000 units of product: net sales $2,310,000; total costs and expenses $1,944,000; and net loss $366,000. costs and expenses consisted of the following. total variable fixed cost of goods sold $1,275,000 $774,000 $501,000 selling expenses 520,000 94,000 426,000 administrative expenses 149,000 56,000 93,000 $1,944,000 $924,000 $1,020,000 management is considering the following independent alternatives for 2017. 1. increase unit selling price 25% with no change in costs and expenses. 2. change the compensation of salespersons from fixed annual salaries totaling $197,000 to total salaries of $40,000 plus a 5% commission on net sales. 3. purchase new high-tech factory machinery that will change the proportion between variable and fixed cost of goods sold to 50: 50. (a) compute the break-even point in dollars for 2016. (round contribution margin ratio to 2 decimal places e. g. 0.25 and final answer to 0 decimal places, e. g. 2,510.) break-even point $ (b) compute the break-even point in dollars under each of the alternative courses of action for 2017. (round contribution margin ratio to 4 decimal places e. g. 0.2512 and final answers to 0 decimal places, e. g. 2,510.)

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 19:20, lukeperry

Astock with a beta of 0.6 has an expected rate of return of 13%. if the market return this year turns out to be 10 percentage points below expectations, what is your best guess as to the rate of return on the stock? (do not round intermediate calculations. enter your answer as a percent rounded to 1 decimal place.)

Answers: 2

Business, 22.06.2019 17:00, nawaphon1395

Alpha company uses the periodic inventory system for purchase & sales of merchandise. discount terms for both purchases & sales are, 2/10, n30 and the gross method is used. unless otherwise noted, fob destination will apply to all purchases & sales. the value of inventory is based on periodic system. on january 1, 2016, beginning inventory consisted of 350 units of widgets costing $10 each. alpha prepares monthly income statements. the following events occurred during the month of jan.: dateactivitya. jan. 3purchased on account 350 widgets for $11 each. b.jan. 5sold on account 400 widgets for $30 each. paid freight out with petty cash of $150.c. jan. 10purchased on account 625 widgets for $12 each. d.jan. 11shipping cost for the january 10 purchased merchandise was $400 was paid with a cheque by alpha directly to the freight company. e.jan. 12returned 50 widgets received from jan. 10 purchase as they were not the correct item ordered. f.jan. 13paid for the purchases made on jan. 3.g. jan. 21sold on account 550 widgets for $30 each. paid freight out with petty cash of $250.h. jan. 22authorize credit without return of goods for 50 widgets sold on jan. 21 when customer advised that they were received in defective condition. i.jan. 25received payment for the sale made on jan. 5.j. jan. 26paid for the purchases made on jan. 10.k. jan. 31received payment for the sale made on jan. 21.use this information to prepare the general journal entries (without explanation) for the january events. if no entry is required then enter the date and write "no entry required."

Answers: 2

Business, 22.06.2019 23:00, hela9astrid

How an absolute advantage might affect a country's imports and exports?

Answers: 2

Business, 23.06.2019 11:10, elysabrina6697

If canada has a surplus of paper products produced but its consumers demand more cleaning solutions, and the us has an abundance of cleaning solutions but consumers are demanding more paper products, how would trade benefit both countries? trade would assist both countries by creating excess demand. trade would assist both countries by strengthening their natural resources. trade would assist both countries to both reduce excess supply and satisfy market demand.

Answers: 3

Do you know the correct answer?

Midlands inc. had a bad year in 2016. for the first time in its history, it operated at a loss. the...

Questions in other subjects:

Mathematics, 21.11.2019 06:31

History, 21.11.2019 06:31

Mathematics, 21.11.2019 06:31

Social Studies, 21.11.2019 06:31