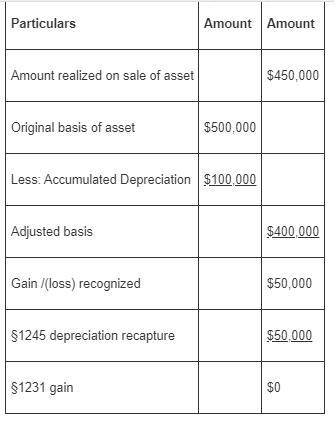

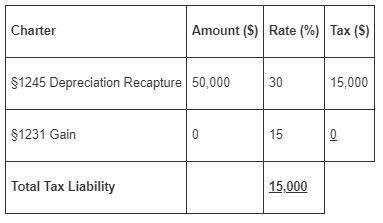

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deductions against the asset. hart has a marginal tax rate of 32 percent. answer the questions presented in the following alternative scenarios (assume hart had no property transactions other than those described in the problem): (loss amounts should be indicated by a minus sign. enter na if a situation is not applicable. leave no answer blank. enter zero if applicable.) required: a1. what is the amount and character of hart’s recognized gain or loss if the asset is tangible personal property sold for $450,000? a2. due to this sale, what tax effect does hart have for the year?

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 14:50, fazegaze89

For fundamental-type variables, list-initialization syntax prevents narrowing conversions that could result in data loss. for fundamental-type variables, list-initialization syntax allows narrowing conversions that could result in data loss.

Answers: 2

Business, 21.06.2019 22:10, angellynn581

3. now assume that carnival booked lady antebellum in december 2016 to perform on the june 2017 western caribbean cruise. further assume that carnival pays lady antebellum its entire performance fee of $52,000 on december 28, 2016, for the june 2017 cruise. what journal entry will carnival make on december 28, 2016, for its payment to lady antebellum?

Answers: 1

Business, 22.06.2019 09:50, niele123

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

Business, 22.06.2019 11:00, samwamooo

Specialization—the division of labor—enhances productivity and efficiency by a) allowing workers to take advantage of existing differences in their abilities and skills. b) avoiding the time loss involved in shifting from one production task to another. c) allowing workers to develop skills by working on one, or a limited number, of tasks. d)all of the means identified in the other answers.

Answers: 2

Do you know the correct answer?

Hart, an individual, bought an asset for $500,000 and has claimed $100,000 of depreciation deduction...

Questions in other subjects:

Mathematics, 06.03.2020 20:57

Mathematics, 06.03.2020 20:57

Mathematics, 06.03.2020 20:57

Mathematics, 06.03.2020 20:57

Mathematics, 06.03.2020 20:58