Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structure is expected not to change. the firm's tax rate is 34%. the firm can issue the following securities to finance capital investments:

debt: capital can be raised through bank loans at a pretax cost of 8.5%. also, bonds can be issued at a pretax cost of 10%.

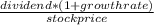

common stock: retained earnings will be available for investment. in addition, new common stock can be issued at the market price of $59. flotation costs will be $3 per share. the recent common stock dividend was $3.15. dividends are expected to grow at 7% in the future.

what is the cost of capital if the firm uses bank loans and retained earnings?

a. 9.9%

b. 10.3%

c. 12.6%

d. 11.8%

e. 10.4%

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:40, nessabear9472

Prairie, inc. produces one single product. it has an annual capacity of 10,000 units, but currently uses only 80% of it. each unit is sold for $50 and requires direct material worth $30 and direct labor worth $5. manufacturing overhead cost is $10 per unit of which 70% is variable. should a special order to sell 1,000 units at $44 be accepted? yes no

Answers: 2

Business, 22.06.2019 19:50, leannamat2106

At the beginning of 2014, winston corporation issued 10% bonds with a face value of $2,000,000. these bonds mature in five years, and interest is paid semiannually on june 30 and december 31. the bonds were sold for $1,852,800 to yield 12%. winston uses a calendar-year reporting period. using the effective-interest method of amortization, what amount of interest expense should be reported for 2014? (round your answer to the nearest dollar.)

Answers: 2

Business, 22.06.2019 20:20, wavymoney77yt

Direct materials (4.2 x $15) $ 63direct labor ($12 x 17.5) $210manufacturing overhead ($2.40 x 17.5) $42total job cost $ 315dougan, inc. allocates overhead based on a predetermined overhead rate of $2.40 per direct labor hour. employees are paid $12.00 per hour. job 24 requires 4.2 pounds of direct materials at a cost of $15.00 per pound. employees worked a total of 17.5 hours to complete the job. actual manufacturing overhead costs totaled $80,000 for the year for the company. how much is the cost of job 24?

Answers: 1

Business, 22.06.2019 23:00, shifaxoxoxo

What is the purpose of the us international trade association?

Answers: 2

Do you know the correct answer?

Southern corporation has a capital structure of 40% debt and 60% common equity. this capital structu...

Questions in other subjects:

English, 21.01.2022 09:50

Mathematics, 21.01.2022 09:50

Mathematics, 21.01.2022 09:50

Health, 21.01.2022 09:50

+ growth rate ........................1

+ growth rate ........................1 + 0.07

+ 0.07