Business, 21.11.2019 03:31, vlactawhalm29

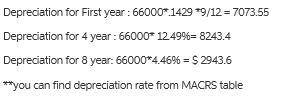

Adigitally controlled plane for manufacturing furniture (macrs-gds 7-year property) is purchased on april 1 by a calendar-year taxpayer for $66,000. it is expected to last 12 years and have a salvage value of $5,000. calculate the depreciation deduction during years 1, 4, and 8 using macrs-gds allowances.

Answers: 2

Similar questions

Business, 31.10.2019 04:31, sheldonwaid4278

Answers: 3

Business, 15.11.2019 23:31, majorsam82

Answers: 1

Business, 22.11.2019 04:31, jumana3

Answers: 2

Do you know the correct answer?

Adigitally controlled plane for manufacturing furniture (macrs-gds 7-year property) is purchased on...

Questions in other subjects:

History, 19.08.2019 22:30

History, 19.08.2019 22:30

Physics, 19.08.2019 22:30

Mathematics, 19.08.2019 22:30

Health, 19.08.2019 22:30

History, 19.08.2019 22:30