Business, 21.11.2019 01:31, Hippiekoolaid

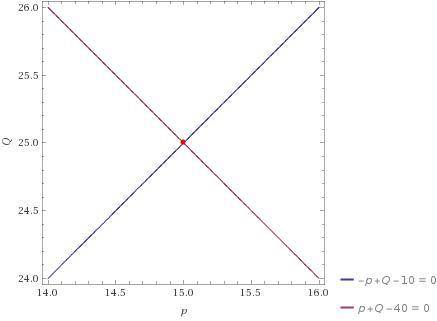

Here are the supply and demand equations for throstles, where p is the price in dollars: d(p) = 40 − p s(p) = 10 + p 1. draw the demand and supply curves for throstles using blue ink. 2. what is the equilibrium price? what is the equilibrium quantity? 3. suppose that the government decides to restrict the industry to selling only 20 throstles. at what price would 20 throstles be demanded? how many throstles would suppliers supply at that price? at what price would the suppliers supply only 20 units? 4. the government wants to make sure that only 20 throstles are bought, but it doesn’t want the firms in the industry to receive more than the minimum price that it would take to have them supply 20 throstles. one way to do this is for the government to issue 20 ration coupons. then in order to buy a throstle, a consumer would need to present a ration coupon along with the necessary amount of money to pay for the good. if the ration coupons were freely bought and sold on the open market, what would be the equilibrium price of these coupons? 5. on the graph, shade in the area that represents the deadweight loss from restricting the supply of throstles to 20. how much is this expressed in dollars?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 13:30, lemmeboiz43

The fiscal 2016 financial statements of nike inc. shows average net operating assets (noa) of $8,450 million, average net nonoperating obligations (nno) of $(4,033) million, average total liabilities of $9,014 million, and average equity of $12,483 million. the company's 2016 financial leverage (flev) is: select one: a. (0.477) b. (0.559 c. (0.323) d. (0.447) e. there is not enough information to determine the ratio.

Answers: 2

Business, 22.06.2019 14:30, benjaminmccutch

Turtle corporation produces and sells a single product. data concerning that product appear below: per unit percent of sales selling price $ 150 100 % variable expenses 75 50 % contribution margin $ 75 50 % the company is currently selling 5,600 units per month. fixed expenses are $194,000 per month. the marketing manager believes that a $5,300 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. what should be the overall effect on the company's monthly net operating income of this change?

Answers: 1

Business, 22.06.2019 15:30, TerronRice

In 2015, lori assigned a paid-up whole life insurance policy to an irrevocable life insurance trust (ilit) for the benefit of her three children. the ilit contained a crummey provision for the benefit of each child. at the time of the transfer, the whole life insurance policy was valued at $200,000, and since lori had not made any other taxable gifts during her lifetime, she did not owe any gift tax. lori died in 2016, and the face value of the whole life insurance policy of $2,000,000 was paid to the ilit. regarding this transfer, how much is included in lori’s gross estate at her death?

Answers: 1

Do you know the correct answer?

Here are the supply and demand equations for throstles, where p is the price in dollars: d(p) = 40...

Questions in other subjects:

Biology, 15.12.2020 16:20

Computers and Technology, 15.12.2020 16:20

Mathematics, 15.12.2020 16:20