Business, 19.11.2019 04:31, gracieorman4

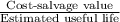

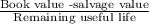

Joe's quik shop bought equipment for $25,000 on january 1, 2006. joe estimated the useful life to be 5 years with no salvage value, and the straight-line method of depreciation will be used. on january 1, 2007, joe decides that the business will use the equipment for a total of 6 years. what is the revised depreciation expense for 2007? a. $4,000b. $2,000c. $3,333d. $5,000

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 17:10, candaceblanton

Titus manufacturing, inc. provided the following information for the year: purchases - direct materials $91,000 plant utilities and insurance 68,000 indirect materials 11,170 indirect labor 4270 direct materials used in production 99,000 direct labor 117,500 depreciation on factory plant & equipment 4000the inventory account balances as of january 1 are given below. direct materials $44,000 work-in-progress inventory 10,000 finished goods inventory 50,000what is the ending balance in the direct materials account? $135,000 $36,000 $110,170 $6000

Answers: 3

Business, 22.06.2019 08:30, dezmondpowell

Which of the following is an example of search costs? a.) driving to a faraway place to find available goods b.) buying goods in some special way that is outside the normal channels c.) paying a premium cost for goods d.) selling extra goods for a discount price

Answers: 1

Business, 22.06.2019 15:40, aroman4511

Rachel died in 2014 and her executor is finalizing her estate tax return. the executor has determined that rachel’s adjusted gross estate is $10,120,000 and that her estate is entitled to a charitable deduction in the amount of $500,000. using 2014 rates, calculate the estate tax liability for rachel’s estate.

Answers: 1

Business, 23.06.2019 01:00, itsmichaelhere1

"consists of larger societal forces that affect how a company engages and serves its customers."

Answers: 1

Do you know the correct answer?

Joe's quik shop bought equipment for $25,000 on january 1, 2006. joe estimated the useful life to be...

Questions in other subjects:

Mathematics, 31.03.2020 13:00

English, 31.03.2020 13:04

Mathematics, 31.03.2020 13:04

Social Studies, 31.03.2020 13:04

Mathematics, 31.03.2020 13:05

Mathematics, 31.03.2020 13:05