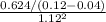

Microsoft presently pays no dividend. you anticipate microsoft will pay an annual dividend of $0.60 per share two years from today and you expect dividends to grow by 4% per year thereafter. if microsoft's equity cost of capital is 12%, then the value of a share of microosfoft today is:

(a) $6.70

(b) $6.90

(c) $5.00

(d) $6.25

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 19:30, jcastronakaya

When it is 4: 00 a. m. in halifax, it is 1: 00 p. m. in karachi, and when it is 9: 00 a. m. in karachi, it is 5: 00 a. m. in warsaw. mary left halifax to fly to karachi, but she accidentally left her watch on warsaw time. according to mary’s watch, she left halifax at 9: 40 p. m. on monday. the local time when she arrived at karachi was 3: 00 p. m. tuesday. how long was mary’s flight? a. 9 hours, 20 minutes b. 13 hours, 20 minutes c. 14 hours, 20 minutes d. 17 hours, 20 minutes

Answers: 1

Business, 22.06.2019 21:30, dondre54

The year-end financial statements of calloway company contained the following elements and corresponding amounts: assets = $34,000; liabilities = ? ; common stock = $6,400; revenue = $13,800; dividends = $1,450; beginning retained earnings = $4,450; ending retained earnings = $8,400. based on this information, the amount of expenses on calloway's income statement was

Answers: 1

Business, 23.06.2019 13:50, cupcake20019peehui

Anthony wants to start making periodic investments in aretirement account. he will make a yearly contribution of$3,000 at the beginning of each year. the account will pay7.2% interest, compounded monthly. how much will hisaccount be worth after 35 years? $369,600$10,560$112,560$490,928.71

Answers: 2

Business, 23.06.2019 23:30, bleesedbeme

Whereas management must deal with the ongoing, day-to-day complexities of organizations, true leadership includes effectively orchestrating change?

Answers: 2

Do you know the correct answer?

Microsoft presently pays no dividend. you anticipate microsoft will pay an annual dividend of $0.60...

Questions in other subjects:

History, 21.01.2021 19:00

Mathematics, 21.01.2021 19:00

Mathematics, 21.01.2021 19:00

Mathematics, 21.01.2021 19:00