Business, 16.11.2019 03:31, Greekfreak

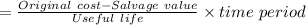

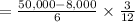

On april 1, 2017, la presa company sells some equipment for $18,000. the original cost was $50,000, the estimated salvage value was $8,000, and the expected useful life was 6 years. on december 31, 2016, the accumulated depreciation account had a balance of $29,400. how much is the gain or loss on the sale?

a) $850 loss

b) $5400 loss

c) $2,600 loss

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:10, hipstergirl225

Beswick company your team is allocated a project involving a major client, the beswick company. although the organization has many clients, this client, and project, is the largest source of revenue and affects the work of several other teams in the organization. the project requires continuous involvement with the client, so any problems with the client are immediately felt by others in the organization. jamie, a member of your team, is the only person in the company with whom this client is willing to deal. it can be said that jamie has:

Answers: 2

Business, 22.06.2019 11:00, andregijoe41

Alocal barnes and noble bookstore ordered 80 marketing books but received 60 books. what percent of the order was missing?

Answers: 1

Business, 22.06.2019 12:00, DeathFightervx

Need today! will get brainliest for right answer! compare and contrast absolute advantage and comparative advantage.

Answers: 1

Business, 22.06.2019 17:50, nayelieangueira

What additional information about the numbers used to compute this ratio might be useful in you assess liquidity? (select all that apply) (a) the maturity schedule of current liabilities (b) the average stock price for the industry (c) the average current ratio for the industry (d) the amount of current assets that is concentrated in relatively illiquid inventories

Answers: 3

Do you know the correct answer?

On april 1, 2017, la presa company sells some equipment for $18,000. the original cost was $50,000,...

Questions in other subjects:

Social Studies, 22.09.2019 00:30

Mathematics, 22.09.2019 00:30

Medicine, 22.09.2019 00:30

History, 22.09.2019 00:30

Mathematics, 22.09.2019 00:30