Business, 15.11.2019 06:31, toricepeda82

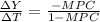

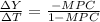

7. suppose the payroll tax reduction for middle-income households has been extended in the amount of $200 billion for the remainder of 2018. assuming the mpc for that income group of households is 0.8 and also assuming that other things stay the same, the increase in gdp under this proposed extension of tax break is expected to increase by (δy)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:30, dontworry48

Lo.2, 3, 9 lori, who is single, purchased 5-years class property for $200,00 and 7-years class property for $420,000 on may 20, 2018. lori experts the taxable income derived form the business (without regard to the amount expensed under ⧠179) to be about $550,000. lori has determined that she should elect immediate ⧠179 expensing in the amount of $520,000, but she doesn’t know which asset she should completely expense under ⧠179. she does not claim any available additional first-year depreciation. a. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 5-year class asset. b. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 7-year class asset. c. what is your advice for lori? d. assume that lori is in the 24% marginal tax bracket and that she uses ⧠179 on the 7-year asset. determine the present value of the tax savings from the depreciation deductions for both assets. see appendix g for present value factors, and assume a 6% discount rate. e. assume the same facts as in part (d), except that lori decides not to use ⧠179 on either asset. determine the present value of the tax savings under this choice. in addition, determine which option lori should choose. f. present your solution to parts (d) and (e) of the problem in a spreadsheet using appropriate microsoft excel formulas. e-mail your spreadsheet to your instructor with a two-paragraph summary of your findings.

Answers: 1

Business, 22.06.2019 13:50, trillsmith

Read the following paragraph, and choose the best revision for one of its sentences. dr. blake is retiring at the end of the month. there will be an unoccupied office upon his departure, and it is big in size. because every other office is occupied, we should convert dr. blake’s office into a lounge. it is absolutely essential that this issue is discussed at the next staff meeting. (a) because every other office is occupied, it’s recommended that we should convert dr. blake’s office into a lounge. (b) because every other office is filled, we should convert dr. blake’s office into a lounge.

Answers: 2

Business, 23.06.2019 13:20, iamasia06

Sam owns speedy bricklayers, inc., a company that specializes in bricklaying. to maintain his business's reputation for quick, quality bricklaying, sam requires that all employees are experienced bricklayers. this discriminates against potential employees who have never laid bricks before. sam is likely:

Answers: 2

Business, 24.06.2019 11:30, FailingstudentXD

Your classmates from the university of chicago are planning to go to miami for spring break, and you are undecided about whether you should go with them. the round-trip airfares are $600, but you have a frequent-flyer coupon worth $500 that you could use to pay part of the airfare. all other costs for the vacation are exactly $900. the most you would be willing to pay for the trip is $1400. your only alternative use for your frequent-flyer coupon is for your trip to atlanta two weeks after the break to attend your sister's graduation, which your parents are forcing you to attend. the chicago-atlanta round-trip airfares are $450. if the chicago-atlanta round-trip airfare were $350, should you use the coupon to go to miami?

Answers: 1

Do you know the correct answer?

7. suppose the payroll tax reduction for middle-income households has been extended in the amount of...

Questions in other subjects:

........................1

........................1