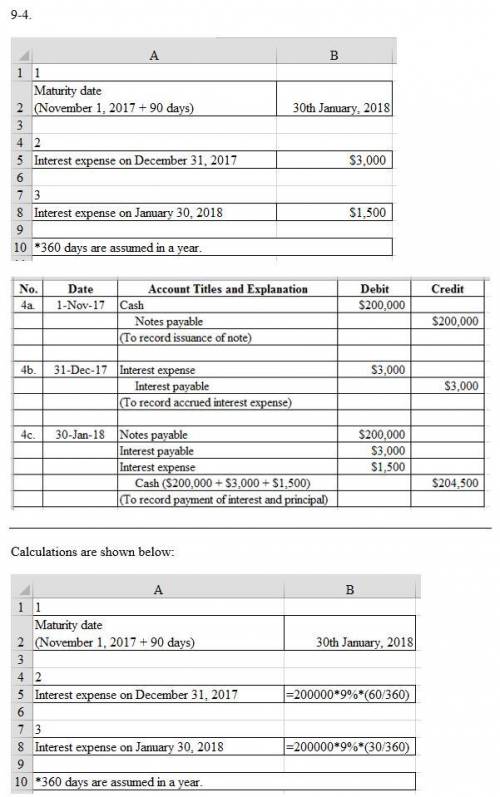

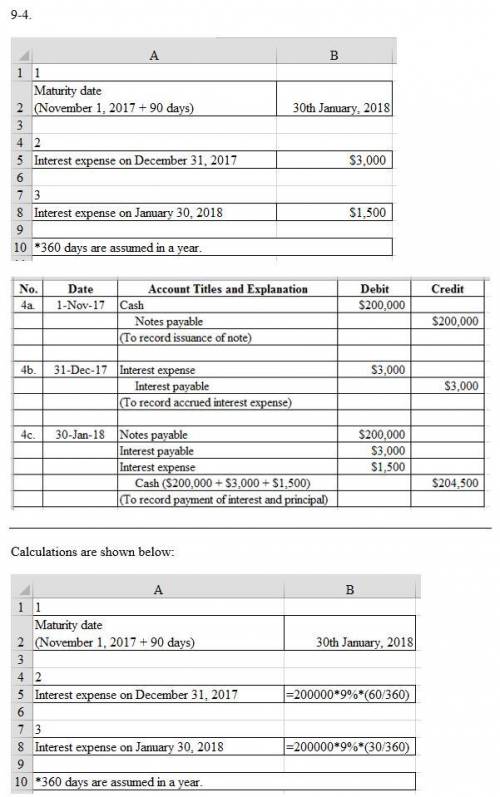

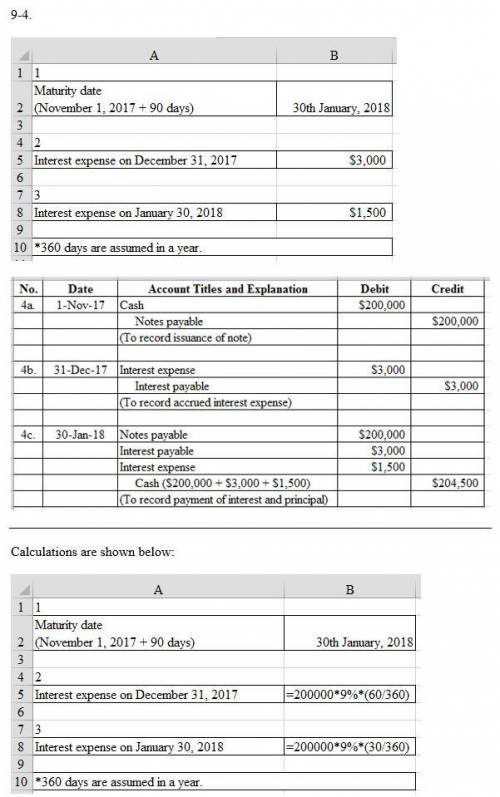

Keesha co. borrows $200,000 cash on november 1, 2017, by signing a 90-day, 9% note with a face value of $200,000. 1. on what date does this note mature? what is the amount of interest expense recorded on 2) december 31, 2017 and 3) january 30, 2018? (use 360 days in the year.) 4 (a) prepare the journal entry to record the issuance of the note on november 1, 2017 4 (b) prepare the journal entry to record the accrual of interest at the end of 2017. 4 (c) prepare the journal entry to record payment of the note at maturity. (assume no reversing entries) exercise 9-10 hitzu co. sold a copier costing $4,800 with a two-year parts warranty to a customer on august 16, 2017 for $6,000 cash. hitzu uses the perpetual inventory system. on november 22, 2018, the copier requires on-site repairs that are completed the same day. the repairs cost $209 for materials taken from the repair parts inventory. these are the only repairs required in 2018 for this copier. based on experience, hitzu expects to incur warranty costs equal to 4% of dollar sales. it records warranty expense with an adjusting entry at the end of each year. 1. how much warranty expense does the company report in 2017 for this copier? 2. how much is the estimated warranty liability for this copier as of december 31, 20177 3. how much warranty expense does the company report in 2018 for this copier? 4. how much is the estimated warranty liability for this copier as of december 31, 2018?

Answers: 1

Similar questions

Business, 09.07.2019 21:20, coolkason

Answers: 3

Business, 09.10.2019 16:20, atlasthegoat

Answers: 1

Business, 10.11.2019 03:31, EthanIsHyper

Answers: 1

Do you know the correct answer?

Keesha co. borrows $200,000 cash on november 1, 2017, by signing a 90-day, 9% note with a face value...

Questions in other subjects:

History, 09.02.2021 16:30

Mathematics, 09.02.2021 16:30

Mathematics, 09.02.2021 16:30

Mathematics, 09.02.2021 16:30