Business, 12.11.2019 00:31, tajanaewilliams77

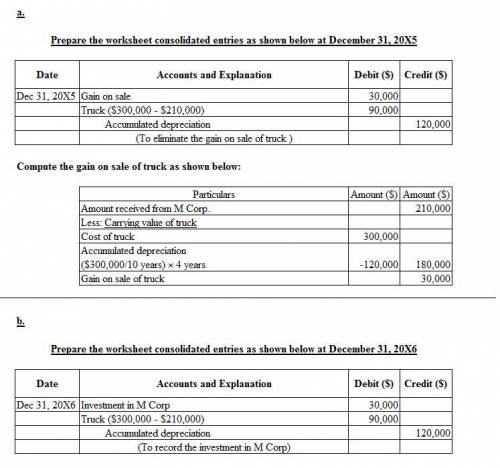

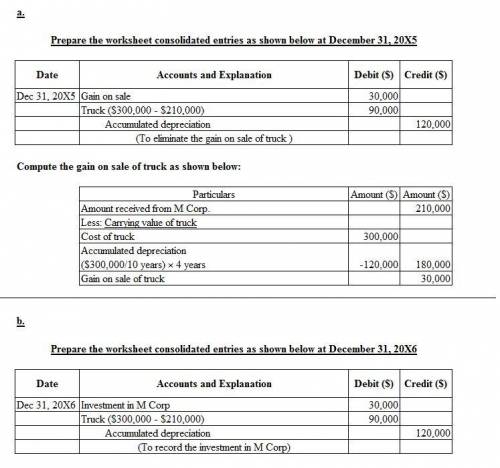

Frazer corporation purchased 60 percent of minnow corporation's voting common stock on january 1, 20x1, at underlying book value. on january 1, 20x5, frazer received $210,000 from minnow for a truck frazer had purchased on january 1, 20x2, for $300,000. the truck is expected to have a 10-year useful life and no salvage value. both companies depreciate trucks on a straight-line basis.

required

a. give the workpaper eliminating entry or entries needed at december 31, 20x5, to remove the effects of the intercompany sale.

b. give the workpaper eliminating entry or entries needed at december 31, 20x6, to remove the effects of the intercompany sale.

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 07:30, yzafer3971

An instance where sellers should work to keep relationships with customers is when they instance where selllars should work to keep relationships with customers is when they feel that the product

Answers: 1

Business, 22.06.2019 19:50, leannamat2106

At the beginning of 2014, winston corporation issued 10% bonds with a face value of $2,000,000. these bonds mature in five years, and interest is paid semiannually on june 30 and december 31. the bonds were sold for $1,852,800 to yield 12%. winston uses a calendar-year reporting period. using the effective-interest method of amortization, what amount of interest expense should be reported for 2014? (round your answer to the nearest dollar.)

Answers: 2

Business, 22.06.2019 21:00, sofiaisabelaguozdpez

Roberto and reagan are both 25 percent owner/managers for bright light inc. roberto runs the retail store in sacramento, ca, and reagan runs the retail store in san francisco, ca. bright light inc. generated a $125,000 profit companywide made up of a $75,000 profit from the sacramento store, a ($25,000) loss from the san francisco store, and a combined $75,000 profit from the remaining stores. if bright light inc. is an s corporation, how much income will be allocated to roberto?

Answers: 2

Do you know the correct answer?

Frazer corporation purchased 60 percent of minnow corporation's voting common stock on january 1, 20...

Questions in other subjects:

Mathematics, 02.12.2019 03:31

Mathematics, 02.12.2019 03:31

Mathematics, 02.12.2019 03:31

Social Studies, 02.12.2019 03:31

Chemistry, 02.12.2019 03:31

History, 02.12.2019 03:31

History, 02.12.2019 03:31