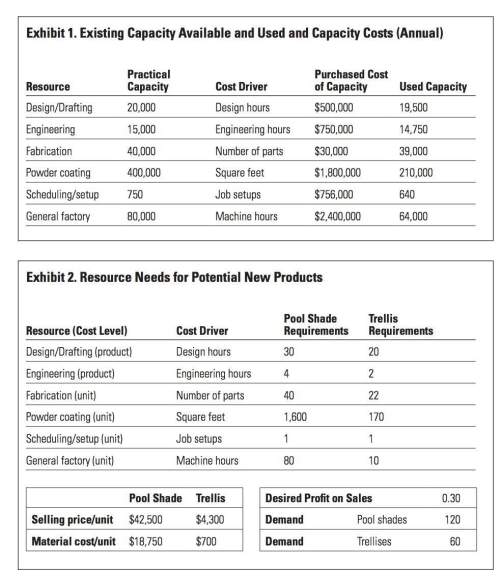

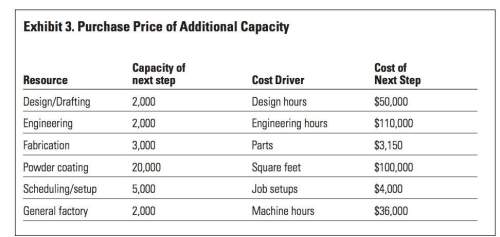

Resource spending approach: assume the decisions to make pool shades and trellises are considered to be a short-term decision and that chandler would make these products one at a time when time is available, so as not to not delay any of the custom orders. because there is excess capacity on current production equipment, the company wants to use a tactical decision (resource spending) approach to evaluate the decision to make the products. exhibit 3 provides information about the cost to purchase additional resources. a. compute the net change in cash flow of making and selling the full demand of pool shades. b. compute the net change in cash flow of making and selling the full demand of trellises. c. compute the net change in cash flow of making the full demand for both the pool shades and the trellises. d. given the assumptions aforementioned (such as short-term and excess capacity), would chandler’s management choose to make either or both of the products? explain your answer.

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 20:30, pegflans314

Which of the following statements is correct? a) one drawback of forming a corporation is that it generally subjects the firm to additional regulationsb) one drawback of forming a corporation is that it subjects the firms investors to increased personal liabilitiesc) one drawback of forming a corporation is that it makes it more difficult for the firm to raise capitald) one advantage of forming a corporation is that it subjects the firm's investors to fewer taxese) one disadvantage of forming a corporation is that it is more difficult for the firm's investors to transfer their ownership interests

Answers: 1

Business, 22.06.2019 10:30, volleyballfun24

Trecek corporation incurs research and development costs of $625,000 in 2017, 30 percent of which relate to development activities subsequent to ias 38 criteria having been met that indicate an intangible asset has been created. the newly developed product is brought to market in january 2018 and is expected to generate sales revenue for 10 years. assume that a u. s.–based company is issuing securities to foreign investors who require financial statements prepared in accordance with ifrs. thus, adjustments to convert from u. s. gaap to ifrs must be made. ignore income taxes. required: (a) prepare journal entries for research and development costs for the years ending december 31, 2017, and december 31, 2018, under (1) u. s. gaap and (2) ifrs. (c) prepare the entry(ies) that trecek would make on the december 31, 2017, and december 31, 2018, conversion worksheets to convert u. s. gaap balances to ifrs.

Answers: 1

Business, 22.06.2019 12:20, ohgeezy

Consider 8.5 percent swiss franc/u. s. dollar dual-currency bonds that pay $666.67 at maturity per sf1,000 of par value. it sells at par. what is the implicit sf/$ exchange rate at maturity? will the investor be better or worse off at maturity if the actual sf/$ exchange rate is sf1.35/$1.00

Answers: 2

Business, 22.06.2019 18:50, saltytaetae

Suppose the government enacts a stimulus program composed of $600 billion of new government spending and $300 billion of tax cuts for an economy currently producing a gdp of $14 comma 000 billion. if all of the new spending occurs in the current year and the government expenditure multiplier is 1.5, the expenditure portion of the stimulus package will add nothing percentage points of extra growth to the economy. (round your response to two decimal places.)

Answers: 3

Do you know the correct answer?

Resource spending approach: assume the decisions to make pool shades and trellises are considered t...

Questions in other subjects:

English, 21.09.2019 18:00

Social Studies, 21.09.2019 18:00

Social Studies, 21.09.2019 18:00

Mathematics, 21.09.2019 18:00