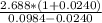

Portman industires just paid a divident of $2.40 per share. the company expects the coming year to be very profitable, and its dividend is expected to grow by 12.00% over the next year. after teh next year, though, portman's divident is expected to grow at a constant rate of 2.40% per year. the risk free rate is 3.00%, the market risk premium is 3.60% and pormans beta is 1.90.assuming taht the market is in equilibriumwhat are the dividends one year from is the horizon is the intrinsic value of portman's is the expected dividend yield for portmant stock today? a. 5.95%

b. 7.44%

c. 7.26%

d. 7.98%

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 20:20, jennybee12331

Precision aviation had a profit margin of 6.25%, a total assets turnover of 1.5, and an equity multiplier of 1.8. what was the firm's roe? a. 15.23%b. 16.03%c. 16.88%d. 17.72%e. 18.60%

Answers: 2

Business, 22.06.2019 21:00, sophiateaches053

Which of the following statements is correct? stockholders should generally be happier than bondholders to have managers invest in risky projects with high potential returns as opposed to safe projects with lower expected returns. potential conflicts between stockholders and bondholders are increased if a firm's bonds are convertible into its common stock. takeovers are most likely to be attempted if the target firm’s stock price is above its intrinsic value. one advantage of operating a business as a corporation is that stockholders can deduct their pro rata share of the taxes the firm pays, thereby eliminating the double taxation investors would face in a partnership.

Answers: 1

Business, 22.06.2019 21:40, QueenNerdy889

Which of the following comes after a period of recession in the business cycle? a. stagflation b. a drought c. a boom d. recovery

Answers: 1

Do you know the correct answer?

Portman industires just paid a divident of $2.40 per share. the company expects the coming year to b...

Questions in other subjects:

Mathematics, 31.08.2019 18:20

English, 31.08.2019 18:20

Mathematics, 31.08.2019 18:20

Mathematics, 31.08.2019 18:20

Social Studies, 31.08.2019 18:20

Mathematics, 31.08.2019 18:20

..................3

..................3

...................4

...................4

......................5

......................5