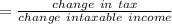

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has the opportunity to earn an additional $5,000 if she accepts and completes a special project at work. there are no additional expenses to offset the $5,000 income. consequently, arlene will have a tax liability of $2,986 if she accepts the special project. arlene has a marginal tax rate of

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 02:30, raulramirez01

Acompany factory is considered which type of resource a. land b. physical capital c. labor d. human capital

Answers: 2

Business, 22.06.2019 07:10, firdausmohammed80

mark, a civil engineer, entered into a contract with david. as per the contract, mark agreed to design and build a house for david for a specified fee. mark provided david with an estimation of the total cost and the contract was mutually agreed upon. however, during construction, when mark increased the price due to a miscalculation on his part, david refused to pay the amount. this scenario is an example of a mistake.

Answers: 1

Business, 22.06.2019 12:50, trintrin227

Afirm’s production function is represented by q(m, r) = 4m 3/4r1/3, where q denotes output, m raw materials, and r robots. the firm is currently using 6 units of raw materials and 12 robots. according to the mrts, in order to maintain its output level the firm would need to give up 2 robots if it adds 9 units of raw materials. (a) true (b) false

Answers: 3

Do you know the correct answer?

Arlene is single and has taxable income of $18,000. her tax liability is currently $2,236. she has t...

Questions in other subjects:

Mathematics, 20.10.2020 21:01

Mathematics, 20.10.2020 21:01

English, 20.10.2020 21:01

Mathematics, 20.10.2020 21:01