Business, 02.11.2019 05:31, PerfectMagZ

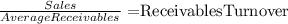

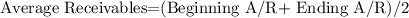

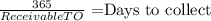

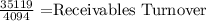

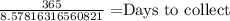

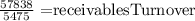

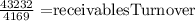

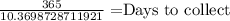

Analyzing allowance for doubtful accounts, receivables turnover ratio, and days to collect [lo 8-4]coca-cola and pepsico are two of the largest and most successful beverage companies in the world in terms of the products that they sell and their receivables management practices. to evaluate their ability to collect on credit sales, consider the following information reported in their 2010, 2009, and 2008 annual reports (amounts in millions).coca-colapepsico fiscal year ended: 2010 2009 2008 2010 2009 2008 net sales $ 35,119 $ 30,990 $ 31,944 $ 57,838 $ 43,232 $ 43,251 accounts receivable 4,478 3,813 3,141 6,467 4,714 3,784 allowance for doubtful accounts 48 55 51 144 90 70 accounts receivable, net of allowance 4,430 3,758 3,090 6,323 4,624 3,714 required: 1. calculate the receivables turnover ratios and days to collect for coca-cola and pepsico for 2010 and 2009. (use 365 days in a year. do not round intermediate calculations on accounts receivable turnover ratio. round your final answers to 1 decimal place. use final rounded answers from accounts receivable turnover ratio for days to collect ratio calculation.)

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 21:00, ummsumaiyah3583

Balance sheet the assets of dallas & associates consist entirely of current assets and net plant and equipment. the firm has total assets of $2 5 million and net plant and equipment equals $2 million. it has notes payable of $150,000, long-term debt of $750,000, and total common equity of $1 5 million. the firm does have accounts payable and accruals on its balance sheet. the firm only finances with debt and common equity, so it has no preferred stock on its balance sheet. a. what is the company's total debt? b. what is the amount of total liabilities and equity that appears on the firm's balance sheet? c. what is the balance of current assets on the firm's balance sheet? d. what is the balance of current liabilities on the firm's balance sheet? e. what is the amount of accounts payable and accruals on its balance sheet? [hint: consider this as a single line item on the firm's balance sheet.] f. what is the firm's net working capital? g. what is the firm's net operating working capital? h. what is the explanation for the difference in your answers to parts f and g?

Answers: 1

Business, 22.06.2019 10:50, iaminu50

Jen left a job paying $75,000 per year to start her own florist shop in a building she owns. the market value of the building is $120,000. she pays $35,000 per year for flowers and other supplies, and has a bank account that pays 5 percent interest. what is the economic cost of jen's business?

Answers: 3

Business, 22.06.2019 20:40, leeshaaa17

Spartan credit bank is offering 7.5 percent compounded daily on its savings accounts. you deposit $5,900 today. a. how much will you have in the account in 4 years? (use 365 days a year. do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. how much will you have in the account in 12 years? (use 365 days a year. do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. how much will you have in the account in 19 years?

Answers: 2

Do you know the correct answer?

Analyzing allowance for doubtful accounts, receivables turnover ratio, and days to collect [lo 8-4]c...

Questions in other subjects:

English, 07.11.2020 06:40

World Languages, 07.11.2020 06:40

Mathematics, 07.11.2020 06:40

Social Studies, 07.11.2020 06:40

Biology, 07.11.2020 06:40

Mathematics, 07.11.2020 06:40

Mathematics, 07.11.2020 06:40