Business, 01.11.2019 06:31, marissasusievalles

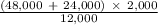

The harold corporation just started business in january of 2010. they had no beginning inventories. during 2010 they manufactured 12,000 units of product, and sold 10,000 units. the selling price of each unit was $20. variable manufacturing costs were $4 per unit, and variable selling and administrative costs were $2 per unit. fixed manufacturing costs were $24,000 and fixed selling and administrative costs were $6,000. what would be the harold corporations net income for 2010 using direct costing?

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 07:50, pattydixon6

The questions of economics address which of the following ? check all that apply

Answers: 3

Business, 22.06.2019 11:00, risolatziyovudd

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Business, 22.06.2019 16:10, boogerbuttday

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 22.06.2019 16:30, cadenbukvich9923

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

Do you know the correct answer?

The harold corporation just started business in january of 2010. they had no beginning inventories....

Questions in other subjects:

History, 29.03.2021 06:00

Chemistry, 29.03.2021 06:00

Health, 29.03.2021 06:00

Mathematics, 29.03.2021 06:00

Chemistry, 29.03.2021 06:00