Business, 29.10.2019 22:31, brentkellen6331

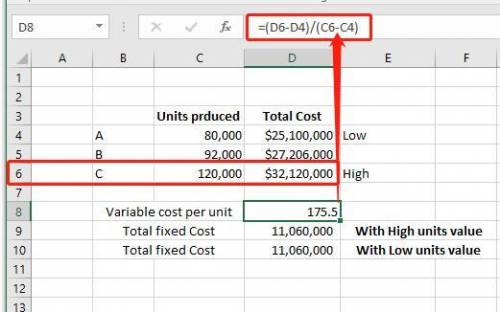

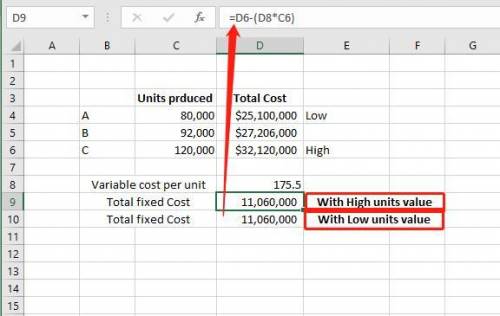

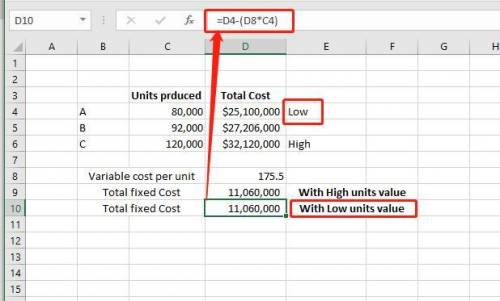

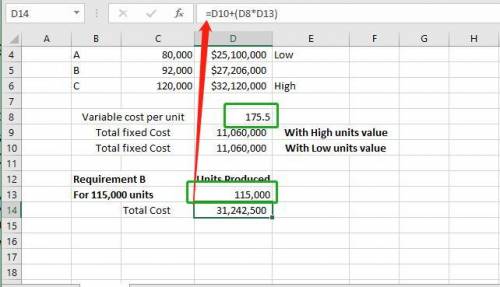

Ex 19-7 high-low method obj . 1 ziegler inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the total cost. the data for various levels of production are as follows: units produced total costs 80,000 $25,100,000 92,000 27,206,000 120,000 32,120,000 a. determine the variable cost per unit and the total fixed cost. b. based on part (a), estimate the total cost for 115,000 units of production. real world show me how a. $30.00 show me how excel template a. $175.50 per unit

Answers: 3

Other questions on the subject: Business

Business, 22.06.2019 07:50, sis212

Connors academy reported inventory in the 2017 year-end balance sheet, using the fifo method, as $154,000. in 2018, the company decided to change its inventory method to lifo. if the company had used the lifo method in 2017, the company estimates that ending inventory would have been in the range $130,000-$135,000. what adjustment would connors make for this change in inventory method?

Answers: 1

Business, 22.06.2019 15:00, shakaylaousley1997

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

Business, 22.06.2019 16:50, bri663

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

Do you know the correct answer?

Ex 19-7 high-low method obj . 1 ziegler inc. has decided to use the high-low method to estimate the...

Questions in other subjects:

Chemistry, 18.10.2020 15:01

Social Studies, 18.10.2020 15:01

Social Studies, 18.10.2020 15:01

Mathematics, 18.10.2020 15:01

History, 18.10.2020 15:01

Biology, 18.10.2020 15:01

Mathematics, 18.10.2020 15:01