Business, 29.10.2019 19:31, Obeilskzexal

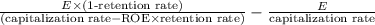

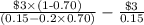

Grott and perrin, inc., has expected earnings of $3 per share for next year. the firm's roe is 20%, and its earnings retention ratio is 70%. if the firm's market capitalization rate is 15%, what is the present value of its growth opportunities?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 17:10, mikailah0988

At the end of the current year, accounts receivable has a balance of $550,000; allowance for doubtful accounts has a credit balance of $5,500; and sales for the year total $2,500,000. an analysis of receivables estimates uncollectible receivables as $25,000. determine the net realizable value of accounts receivable after adjustment. (hint: determine the amount of the adjusting entry for bad debt expense and the adjusted balance of allowance of doubtful accounts.)

Answers: 3

Business, 22.06.2019 19:20, goofy44

Royal motor corp. generates a major portion of its revenues by manufacturing luxury sports cars. however, the company also derives an insignificant percent of its annual revenues by selling its sports merchandise that includes apparel, shoes, and other accessories under the same brand name. which of the following terms best describes royal motor corp.? a. aconglomerate b. a subsidiary c. adominant-businessfirm d. a single-business firm

Answers: 1

Business, 22.06.2019 19:30, cyynntthhiiaa4

Fly-by products, inc. operates primarily in the united states and has several segments. for the following segment, determine whether it is a cost center, profit center, or investment center: international operations- acts as an independent segment responsible for all facets of the business outside of the united states. select one: a. cost center b. profit center c. investment center

Answers: 2

Do you know the correct answer?

Grott and perrin, inc., has expected earnings of $3 per share for next year. the firm's roe is 20%,...

Questions in other subjects:

Mathematics, 18.03.2021 03:00

World Languages, 18.03.2021 03:00

Chemistry, 18.03.2021 03:00

Mathematics, 18.03.2021 03:00