Business, 29.10.2019 03:31, esperanzar5755

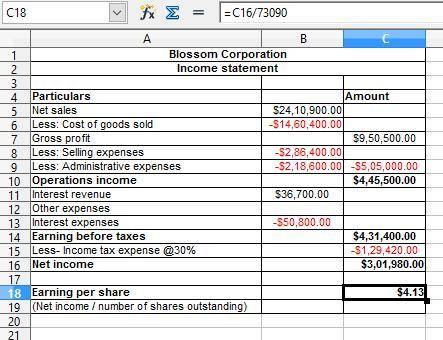

Blossom corporation had net sales of $2,410,900 and interest revenue of $36,700 during 2017. expenses for 2017 were cost of goods sold $1,460,400, administrative expenses $218,600, selling expenses $286,400, and interest expense $50,800. blossom’s tax rate is 30%. the corporation had 105,200 shares of common stock authorized and 73,090 shares issued and outstanding during 2017. prepare a condensed multiple-step income statement for blossom corporation.

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 09:50, sanam3035

For each of the following users of financial accounting information and managerial accounting information, specify whether the user would primarily use financial accounting information or managerial accounting information or both: 1. sec examiner 2. bookkeeping department 3. division controller 4. external auditor (public accounting firm) 5. loan officer at the company's bank 6. state tax agency auditor 7. board of directors 8. manager of the service department 9. wall street analyst 10. internal auditor 11. potential investors 12, current stockholders 13. reporter from the wall street journal 14. regional division managers

Answers: 1

Business, 22.06.2019 14:00, lindjyzeph

The following costs were incurred in may: direct materials $ 44,800 direct labor $ 29,000 manufacturing overhead $ 29,300 selling expenses $ 26,800 administrative expenses $ 37,100 conversion costs during the month totaled:

Answers: 2

Business, 22.06.2019 15:30, thall5026

Calculate the required rate of return for climax inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real risk-free rate is 3.0%, (3) the market risk premium is 5.0%, (4) the firm has a beta of 2.30, and (5) its realized rate of return has averaged 15.0% over the last 5 years. do not round your intermediate calculations.

Answers: 3

Business, 22.06.2019 16:30, piratesfc02

Suppose that electricity producers create a negative externality equal to $5 per unit. further suppose that the government imposes a $5 per-unit tax on the producers. what is the relationship between the after-tax equilibrium quantity and the socially optimal quantity of electricity to be produced?

Answers: 2

Do you know the correct answer?

Blossom corporation had net sales of $2,410,900 and interest revenue of $36,700 during 2017. expense...

Questions in other subjects:

Biology, 21.04.2021 18:10

Social Studies, 21.04.2021 18:10

Mathematics, 21.04.2021 18:10

Mathematics, 21.04.2021 18:10