Business, 25.10.2019 02:43, yclark98563p5z2gt

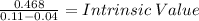

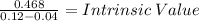

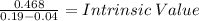

King waterbeds has an annual cash dividend policy that raises the dividend each year by 44%. the most recent dividend, div 0div0, was $ 0.45$0.45 per share. what is the stock's price if a. an investor wants a return of 66%? b. an investor wants a return of 88%? c. an investor wants a return of %? d. an investor wants a return of 1212%? e. an investor wants a return of 1919%? a. what is the stock's price if an investor wants a return of 66%?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 05:10, russboys3

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 13:50, veronica25681

When used-car dealers signal the quality of a used car with a warranty, a. buyers believe the signal because the cost of a false signal is high b. it is not rational to believe the signal because some used-car dealers are crooked c. the demand for lemons is eliminated d. the price of a lemon rises above the price of a good used car because warranty costs on lemons are greater than warranty costs on good used cars

Answers: 2

Business, 22.06.2019 23:50, yatayjenings12

Analyzing operational changes operating results for department b of delta company during 2016 are as follows: sales $540,000 cost of goods sold 378,000 gross profit 162,000 direct expenses 120,000 common expenses 66,000 total expenses 186,000 net loss $(24,000) suppose that department b could increase physical volume of product sold by 10% if it spent an additional $18,000 on advertising while leaving selling prices unchanged. what effect would this have on the department's net income or net loss? (ignore income tax in your calculations.) use a negative sign to indicate a net loss answer; otherwise do not use negative signs with your answers. sales $answer cost of goods sold answer gross profit answer direct expenses answer common expenses answer total expenses answer net income (loss) $answer

Answers: 1

Do you know the correct answer?

King waterbeds has an annual cash dividend policy that raises the dividend each year by 44%. the mos...

Questions in other subjects:

Spanish, 29.07.2019 07:00

History, 29.07.2019 07:00

Mathematics, 29.07.2019 07:00

Chemistry, 29.07.2019 07:00