Business, 24.10.2019 05:00, Christinelove23

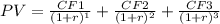

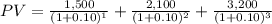

Anthony operates a part time auto repair service. he estimates that a new diagnostic computer system will result in increased cash inflows of $1,500 in year 1, $2,100 in year 2, and $3,200 in year 3. if anthony's required rate of return is 10%, then the most he would be willing to pay for the new diagnostic computer system would be (ignore income taxes.):

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 16:10, emmaja121003

Baldwin has negotiated a new labor contract for the next round that will affect the cost for their product bold. labor costs will go from $7.91 to $8.41 per unit. in addition, their material costs have fallen from $13.66 to $12.66. assume all period costs as reported on baldwin's income statement remain the same. if baldwin were to pass on half the new costs of labor and half the savings in materials to customers by adjusting the price of their product, how many units of product bold would need to be sold next round to break even on the product?

Answers: 2

Business, 21.06.2019 23:10, josie311251

At the end of the current year, $59,500 of fees have been earned but have not been billed to clients. required: a. journalize the adjusting entry to record the accrued fees on december 31. refer to the chart of accounts for exact wording of account titles. b. if the cash basis rather than the accrual basis had been used, would an adjusting entry have been necessary?

Answers: 2

Business, 22.06.2019 07:30, dimondqueen511

Which two of the following are benefits of consumer programs

Answers: 1

Do you know the correct answer?

Anthony operates a part time auto repair service. he estimates that a new diagnostic computer system...

Questions in other subjects:

English, 29.09.2019 06:10

Health, 29.09.2019 06:10

English, 29.09.2019 06:10