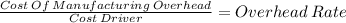

At the beginning of the year, horvath company estimated the following: overhead $270,000 direct labor hours 90,000 horvath uses normal costing and applies overhead on the basis of direct labor hours. for the month of january, direct labor hours were 8,350. by the end of the year, horvath showed the following actual amounts: overhead $276,000 direct labor hours 89,600 assume that unadjusted cost of goods sold for horvath was $396,000. required: 1. calculate the predetermined overhead rate for horvath. round your answers to the nearest cent, if rounding is required. $ per direct labor hour 2. calculate the overhead applied to production in january. (note: round to the nearest dollar, if rounding is required.) $ 3. calculate the total applied overhead for the year. $ was overhead over- or underapplied

Answers: 1

Other questions on the subject: Business

Business, 22.06.2019 14:00, lindjyzeph

The following costs were incurred in may: direct materials $ 44,800 direct labor $ 29,000 manufacturing overhead $ 29,300 selling expenses $ 26,800 administrative expenses $ 37,100 conversion costs during the month totaled:

Answers: 2

Business, 22.06.2019 23:20, chrisgaz14

Suppose you manage an upscale restaurant in new york city. would involve writing employee schedules and a list of things to do for the chef and other kitchen staff

Answers: 3

Business, 22.06.2019 23:50, Izzyfizzy

Cash flows during the first year of operations for the harman-kardon consulting company were as follows: cash collected from customers, $360,000; cash paid for rent, $44,000; cash paid to employees for services rendered during the year, $124,000; cash paid for utilities, $54,000.in addition, you determine that customers owed the company $64,000 at the end of the year and no bad debts were anticipated. also, the company owed the gas and electric company $2,400 at year-end, and the rent payment was for a two-year period. calculate accrual net income for the year.

Answers: 2

Business, 23.06.2019 20:00, loudenalexisp56lp0

Harveys corporation borrowed $60,000 from the bank on november 1, 2014. the note had a 6 percent annual rate of interest and matured on april 30, 2015. interest and principal were paid in cash on the maturity date. required a. what amount of interest expense was paid in cash in 2014?

Answers: 1

Do you know the correct answer?

At the beginning of the year, horvath company estimated the following: overhead $270,000 direct lab...

Questions in other subjects:

Health, 17.06.2021 22:30

English, 17.06.2021 22:30

Social Studies, 17.06.2021 22:30