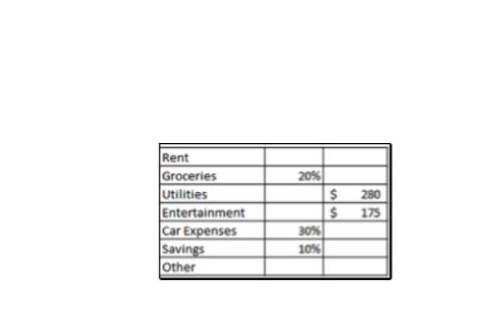

Amina makes $48,000 per year before taxes, and takes homes around $3,500 each month. given below is an unfinished table representing her monthly budget. complete the table and answer the questions below. (17 points: part i - 1 point; part ii 2 points; part iii - 1 point; part v - 5 points; part vi - 1 point; part vii - 6 points)

part i: what is the "rule of thumb" on how much amina should spend each month on rent? (1 point)

part ii: using the rule of thumb, calculate amina's monthly budget for rent. express the rent as a percentage of take-home pay ( round both answers to the nearest whole number). (2 points: 1 point each)

part iii: how much does amina spend each month on groceries? (1 point)

part iv: what percentage of her take-home pay is spent on utilities? (1 point)

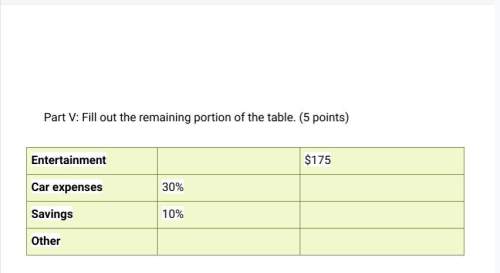

part v: fill out the remaining portion of the table. (5 points) (will provide pictures below)

part vi: arrange amina's expenses from greatest to least. (1 point)

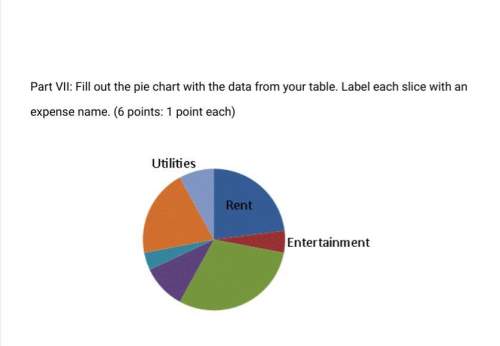

part vii: fill out the pie chart with the data from your table. label each slice with an expense name. (6 points: 1 point each)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 03:30, dontworry48

Lo.2, 3, 9 lori, who is single, purchased 5-years class property for $200,00 and 7-years class property for $420,000 on may 20, 2018. lori experts the taxable income derived form the business (without regard to the amount expensed under ⧠179) to be about $550,000. lori has determined that she should elect immediate ⧠179 expensing in the amount of $520,000, but she doesn’t know which asset she should completely expense under ⧠179. she does not claim any available additional first-year depreciation. a. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 5-year class asset. b. determine lori’s total cost recovery deduction if the ⧠179 expense is first taken with respect to the 7-year class asset. c. what is your advice for lori? d. assume that lori is in the 24% marginal tax bracket and that she uses ⧠179 on the 7-year asset. determine the present value of the tax savings from the depreciation deductions for both assets. see appendix g for present value factors, and assume a 6% discount rate. e. assume the same facts as in part (d), except that lori decides not to use ⧠179 on either asset. determine the present value of the tax savings under this choice. in addition, determine which option lori should choose. f. present your solution to parts (d) and (e) of the problem in a spreadsheet using appropriate microsoft excel formulas. e-mail your spreadsheet to your instructor with a two-paragraph summary of your findings.

Answers: 1

Business, 22.06.2019 12:50, trintrin227

Afirm’s production function is represented by q(m, r) = 4m 3/4r1/3, where q denotes output, m raw materials, and r robots. the firm is currently using 6 units of raw materials and 12 robots. according to the mrts, in order to maintain its output level the firm would need to give up 2 robots if it adds 9 units of raw materials. (a) true (b) false

Answers: 3

Business, 22.06.2019 19:00, makaylahunt

James is an employee in the widget inspection department of xyz systems, a government contractor. james was part of a 3-person inspection team that found a particular batch of widgets did not meet the exacting requirements of the u. s. government. in order to meet the tight deadline and avoid penalties under the contract, james' boss demanded that the batch of widgets be sent in fulfillment of the government contract. when james found out, he went to the vice president of the company and reported the situation. james was demoted by his boss, and no longer works on government projects. james has a:

Answers: 3

Business, 22.06.2019 19:50, hallkanay7398

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

Do you know the correct answer?

Amina makes $48,000 per year before taxes, and takes homes around $3,500 each month. given below is...

Questions in other subjects:

English, 15.04.2020 19:42