Cougar corp (december 31st fiscal year end) purchased a piece of machinery, which it will use to produce inventory, on august 1st, 2016 for $450,000. the estimated salvage value is $50,000. the estimated useful life is 4-years. the estimated total activity levels for this machinery over its useful life are production of 1,000,000 units of inventory and working hours of 50,000 hours.

actual activity for 2016-2018 is as follows: 2016: 100,000 units of inventory produced; 8,500 working hours. 2017: 275,000 units of inventory produced; 14,000 working hours. if necessary, round your answer to the nearest dollar. do not use dollar signs or decimals.

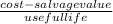

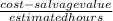

(a) what is the amount of accumulated depreciation associated with this machinery as of december 31st, 2018 assuming cougar corp uses straight-line depreciation?

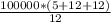

(b) what is the amount of depreciation expense for this machinery in 2016 assuming cougar corp uses activity based depreciation based on working hours?

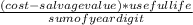

(c) what is the book value (cost - accumulated depreciation) associated with this machinery as of december 31st, 2017 assuming cougar corp uses sum-of-the-years'-digits depreciation method?

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 10:40, esta54

At cooly cola, we are testing the appeal of our new diet one cola. in a taste test of 250 randomly chosen cola drinkers, 200 consumers preferred diet one cola to the leading brand. assuming that the sample were large enough, the large-sample 95% confidence interval for the population proportion of cola drinkers that prefer diet one cola would be:

Answers: 1

Business, 22.06.2019 20:00, Haddixhouse8948

How many organs are supplied at a zero price? (b) how many people die in the government-regulated economy where the government-set price ceiling is p = 0? the quantity qd – qa. the quantity qe – qa. the quantity qd – qe. (c) how many people die in the market-driven economy?

Answers: 1

Business, 23.06.2019 00:50, Turtlelover05

Exercise 12-7 shown below are comparative balance sheets for flint corporation. flint corporation comparative balance sheets december 31 assets 2017 2016 cash $ 201,348 $ 65,142 accounts receivable 260,568 225,036 inventory 494,487 559,629 land 236,880 296,100 equipment 769,860 592,200 accumulated depreciation—equipment (195,426 ) (94,752 ) total $1,767,717 $1,643,355 liabilities and stockholders’ equity accounts payable $ 115,479 $ 127,323 bonds payable 444,150 592,200 common stock ($1 par) 639,576 515,214 retained earnings 568,512 408,618 total $1,767,717 $1,643,355 additional information: 1. net income for 2017 was $275,373. 2. depreciation expense was $100,674. 3. cash dividends of $115,479 were declared and paid. 4. bonds payable amounting to $148,050 were redeemed for cash $148,050. 5. common stock was issued for $124,362 cash. 6. no equipment was sold during 2017. 7. land was sold for its book value. prepare a statement of cash flows for 2017 using the indirect method.

Answers: 1

Business, 23.06.2019 01:00, marioshadowman12

To travelers know what to expect researchers collect the prices of commodities

Answers: 2

Do you know the correct answer?

Cougar corp (december 31st fiscal year end) purchased a piece of machinery, which it will use to pro...

Questions in other subjects:

Mathematics, 12.12.2020 16:10

Mathematics, 12.12.2020 16:10

Computers and Technology, 12.12.2020 16:10

= 160000

= 160000 = 120000

= 120000 = 50000

= 50000