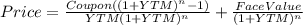

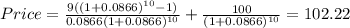

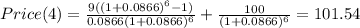

Suppose you purchase a ten-year bond with 9% annual coupons. you hold the bond for four years and sell it immediately after receiving the fourth coupon. if the bond’s ytm was 8.66% when you purchased and sold the bond. what cash flows will you pay at the purchase and what cash flows will you receive at the sale (including any coupon received immediately before sale) from you investment in the bond per $100 face value? how much interest income will you earn for holding this bond for four years in total?

Answers: 1

Similar questions

Business, 01.11.2019 04:31, dub7

Answers: 3

Business, 20.11.2019 02:31, rileigh2302

Answers: 1

Do you know the correct answer?

Suppose you purchase a ten-year bond with 9% annual coupons. you hold the bond for four years and se...

Questions in other subjects:

Mathematics, 15.06.2021 02:50

Mathematics, 15.06.2021 02:50

History, 15.06.2021 02:50

Mathematics, 15.06.2021 02:50

History, 15.06.2021 02:50

Chemistry, 15.06.2021 02:50