Business, 16.10.2019 04:20, madisoncfrew

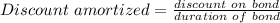

Jones company issued bonds with a $200,000 face value on january 1, year 1. the five-year term bonds were issued at 97 and had a 7½% stated rate of interest that is payable in cash on december 31st of each year. jones amortizes the bond discount using the straight-line method. based on this information: the amount of interest expense shown on jones's december 31, year 1 income statement would be:

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 21:20, khalilh1206

Vital industries manufactured 2 comma 200 units of its product huge in the month of april. it incurred a total cost of $ 121 comma 000 during the month. out of this $ 121 comma 000, $ 46 comma 000 comprised of direct materials used in the product and the rest was incurred because of the conversion cost involved in the process. ryan had no opening or closing inventory. what will be the total cost per unit of the product, assuming conversion costs contained $ 10 comma 900 of indirect labor?

Answers: 1

Business, 22.06.2019 09:50, niele123

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

Business, 23.06.2019 01:40, Karinaccccc

The petty cash fund has a current balance of $ 350, which is the established fund balance. based on activity in the fund, it is determined that the balance needs to be changed to $ 450. which journal entry is needed to make this change?

Answers: 3

Do you know the correct answer?

Jones company issued bonds with a $200,000 face value on january 1, year 1. the five-year term bonds...

Questions in other subjects:

Mathematics, 04.02.2020 14:49

Mathematics, 04.02.2020 14:49

Mathematics, 04.02.2020 14:49

Mathematics, 04.02.2020 14:49