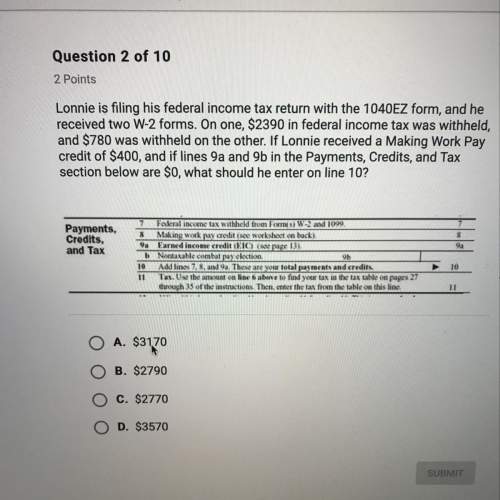

Lonnie is filing his federal income tax return with the 1040ez form, and he

received two w-2 f...

Business, 16.10.2019 04:10, mattdallas6214

Lonnie is filing his federal income tax return with the 1040ez form, and he

received two w-2 forms. on one, $2390 in federal income tax was withheld,

and $780 was withheld on the other. if lonnie received a making work pay

credit of $400, and if lines 9a and 9b in the payments, credits, and tax

section below are $0, what should he enter on line 10?

payments.

credits,

and tax

3

9

federal income tax withheld from formis) w2 and 1099

making work pay credit (see worksheet on back)

earned income credit to see pape 13)

nectable combat pay election

add lines 7.8.anda. these are your total payments and credits

tau. use the amount on line 6 above to find your tax in the tax table on pages 27

through 35 of the instructions. then, enter the tax from the table on this line

10

o a. $3170

b. $2790

o c. $2770

o d. $3570

Answers: 2

Other questions on the subject: Business

Business, 21.06.2019 19:40, muhammadcorley123456

Anew equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. the investment cost is $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. increased productivity attributable to the equipment will amount to $10,000 per year after operating costs have been subtracted from the revenue generated by the additional production. if marr is 10%, is investing in this equipment feasible? use annual worth method.

Answers: 3

Business, 21.06.2019 21:00, yasmineeee96371

Jurvin enterprises is a manufacturing company that had no beginning inventories. a subset of the transactions that it recorded during a recent month is shown below. $76,700 in raw materials were purchased for cash. $71,400 in raw materials were used in production. of this amount, $66,300 was for direct materials and the remainder was for indirect materials. total labor wages of $151,700 were incurred and paid. of this amount, $134,300 was for direct labor and the remainder was for indirect labor. additional manufacturing overhead costs of $126,300 were incurred and paid. manufacturing overhead of $126,800 was applied to production using the company's predetermined overhead rate. all of the jobs in process at the end of the month were completed. all of the completed jobs were shipped to customers. any underapplied or overapplied overhead for the period was closed to cost of goods sold. required: 1. post the above transactions to t-accounts.2. determine the cost of goods sold for the period.

Answers: 1

Business, 22.06.2019 01:30, rome58

The gomez company, a merchandising firm, has budgeted its activity for december according to the following information: • sales at $500,000, all for cash. • merchandise inventory on november 30 was $250,000. • the cash balance at december 1 was $20,000. • selling and administrative expenses are budgeted at $50,000 for december and are paid for in cash. • budgeted depreciation for december is $30,000. • the planned merchandise inventory on december 31 is $260,000. • the cost of goods sold represents 75% of the selling price. • all purchases are paid for in cash. the budgeted cash disbursements for december are:

Answers: 3

Business, 22.06.2019 02:30, raulramirez01

Acompany factory is considered which type of resource a. land b. physical capital c. labor d. human capital

Answers: 2

Do you know the correct answer?

Questions in other subjects:

Biology, 10.11.2021 03:00

Mathematics, 10.11.2021 03:00

Biology, 10.11.2021 03:00

Mathematics, 10.11.2021 03:00

Mathematics, 10.11.2021 03:00

Mathematics, 10.11.2021 03:00

English, 10.11.2021 03:00

Biology, 10.11.2021 03:00