Business, 10.10.2019 05:10, hcarcel8287

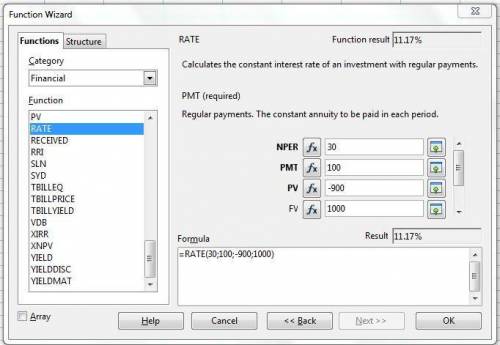

Nico trading corporation is considering issuing longdashterm debt. the debt would have a 30dashyear maturity and a 10 percent coupon rate. in order to sell the issue, the bonds must be underpriced at a discount of 5 percent of face value. in addition, the firm would have to pay flotation costs of 5 percent of face value. the firm's tax rate is 21 percent. given this information, the afterdashtax cost of debt for nico trading would be

Answers: 3

Other questions on the subject: Business

Business, 21.06.2019 21:30, meababy2009ow9ewa

1. gar principles or "the principles"are intended to do what? a. foster an awareness of the hierarchical structure of the organization b. explain the best method of implementing biometric security techniques c. foster an awareness of the importance of good employee training d. foster an awareness of getting upper level management on board in understanding the need to implement an ig program e. foster an awareness of good record keeping principles

Answers: 1

Business, 22.06.2019 09:00, tiffanibell71

Asap describe three different expenses associated with restaurants. choose one of these expenses, and discuss how a manager could handle this expense.

Answers: 1

Business, 22.06.2019 12:10, lucyamine0

Compute the cost of not taking the following cash discounts. (use a 360-day year. do not round intermediate calculations. input your final answers as a percent rounded to 2 decimal places.)

Answers: 1

Business, 22.06.2019 16:50, taylorb9893

According to ceo heidi ganahl, camp bow wow requires a strong and consistent corporate culture to keep all local franchise owners "on the same page" and to follow a common template for the business and brand. this culture could become detrimental over time because: (a) strong consistent cultures are inflexible and incapable of adapting to environmental change (b) strong consistent cultures are too flexible and capable of adapting to environmental change (c) strong consistent cultures don’t perform well in any environment (d) the passing of time provides stability and predictability for businesses

Answers: 2

Do you know the correct answer?

Nico trading corporation is considering issuing longdashterm debt. the debt would have a 30dashyear...

Questions in other subjects:

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Biology, 17.09.2020 01:01

Physics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01

Mathematics, 17.09.2020 01:01