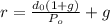

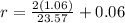

Columbus manufacturing's stock currently sells for $ 23.57 a share. the stock just paid a dividend of $2 a share (i. e.,d0=2). the dividend is expected to grow at a constant rate of 6 % a year. what is the required rate of return on the company's stock? express your answer in percentage, and round it to two decimal places, i. e., 13.54, for example for 0.1354)

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 01:30, mobslayer88

Iam trying to get more members on my blog. how do i do this?

Answers: 3

Business, 22.06.2019 16:00, winstonbendariovvygn

If the family’s net monthly income is 7,800 what percent of the income is spent on food clothing and housing?

Answers: 3

Business, 22.06.2019 20:00, kylewinfrey2638

If an investment has 35 percent more nondiversifiable risk than the market portfolio, its beta will be:

Answers: 1

Business, 23.06.2019 00:50, chancho3703

Amanufacturing firm is considering overhauling the existing compensation strategy. currently every front line employee who works on the assembly line earns the same hourly wage. ideally, management would like to institute a new pay system that involves pay-for-performance. which of the following recommendations is both consistent with scientific management's general emphases and generally good advice for management of this firma. the firm should adopt a differential pay system with one pay level for average performance, and a higher level for good performance. b. the firm should adopt a differential pay system, but the firm should modify it from its original design and provide many different levels of pay associated with different performance levels. c. the firm should understand worker psychology and to focus on pay as the key motivator. d. all of the abovee. none of the above

Answers: 1

Do you know the correct answer?

Columbus manufacturing's stock currently sells for $ 23.57 a share. the stock just paid a dividend o...

Questions in other subjects:

English, 25.03.2020 20:01

English, 25.03.2020 20:01