Business, 01.10.2019 05:00, kendasinjab

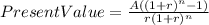

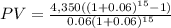

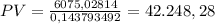

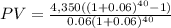

An investment offers $4,350 per year for 15 years, with the first payment occurring one year from now. a. if the required return is 6 percent, what is the value of the investment? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) b. what would the value be if the payments occurred for 40 years? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) c. what would the value be if the payments occurred for 75 years? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.) d. what would the value be if the payments occurred forever? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.1

Answers: 2

Other questions on the subject: Business

Business, 22.06.2019 08:00, shatj960

Suppose the number of equipment sales and service contracts that a store sold during the last six (6) months for treadmills and exercise bikes was as follows: treadmill exercise bike total sold 185 123 service contracts 67 55 the store can only sell a service contract on a new piece of equipment. of the 185 treadmills sold, 67 included a service contract and 118 did not.

Answers: 1

Business, 22.06.2019 13:50, 2023apd

Diamond motor car company produces some of the most luxurious and expensive cars in the world. typically, only a single dealership is authorized to sell its cars in certain major cities. in less populous areas, diamond authorizes a single dealer for an entire state or region. the manufacturer of diamond automobiles is using a(n) distribution strategy for its product.

Answers: 2

Business, 22.06.2019 14:00, gcristhian8863

Which of the following would be an accurate statement about achieving a balanced budget

Answers: 1

Business, 22.06.2019 19:20, kimmosley80

Although appealing to more refined tastes, art as a collectible has not always performed so profitably. during 2003, an auction house sold a sculpture at auction for a price of $10,211,500. unfortunately for the previous owner, he had purchased it in 2000 at a price of $12,177,500. what was his annual rate of return on this sculpture? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as

Answers: 2

Do you know the correct answer?

An investment offers $4,350 per year for 15 years, with the first payment occurring one year from no...

Questions in other subjects:

Physics, 14.07.2020 23:01

Biology, 14.07.2020 23:01

Physics, 14.07.2020 23:01