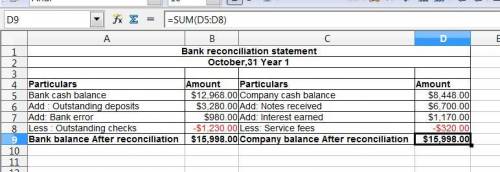

On october 31, year 1, a company general ledger shows a checking account balance of $8,448. the company’s cash receipts for the month total $74,660, of which $71,380 has been deposited in the bank. in addition, the company has written checks for $72,518, of which $71,288 has been processed by the bank. the bank statement reveals an ending balance of $12,968 and includes the following items not yet recorded by the company: bank service fees of $320, note receivable collected by the bank of $6,700, and interest earned on the account balance plus from the note of $1,170. after closer inspection, the company realizes that the bank incorrectly charged the company’s account $980 for an automatic withdrawal that should have been charged to another customer’s account. the bank agrees to the error. required: 1. prepare a bank reconciliation to calculate the correct ending balance of cash on october 31, year 1. (amounts to be deducted should be indicated with a minus sign.)

Answers: 2

Similar questions

Business, 01.10.2019 19:30, YeshaKira

Answers: 2

Business, 06.10.2019 05:30, bestielove7425

Answers: 3

Business, 06.10.2019 07:01, hfleysher

Answers: 1

Business, 07.10.2019 21:00, jhick9279

Answers: 2

Do you know the correct answer?

On october 31, year 1, a company general ledger shows a checking account balance of $8,448. the comp...

Questions in other subjects:

Biology, 14.12.2020 18:20

Mathematics, 14.12.2020 18:20

History, 14.12.2020 18:20