Adriana company is highly automated and uses computers to control manufacturing operations. the company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of computer-hours. the following estimates were used in preparing the predetermined overhead rate at the beginning of the year:

computer-hours 82,000

fixed manufacturing overhead cost $ 1,278,000

variable manufacturing overhead per computer-hour $ 3.40

during the year, a severe economic recession resulted in cutting back production and a buildup of inventory in the company�s warehouse. the company�s cost records revealed the following actual cost and operating data for the year:

computer-hours 60,000

manufacturing overhead cost $ 1,208,000

inventories at year-end:

raw materials $ 420,000

work in process $ 120,000

finished goods $ 1,030,000

cost of goods sold $ 2,770,000

required:

1.

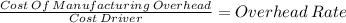

compute the company�s predetermined overhead rate for the year. (round your answer to two decimal places.)

predetermined overhead rate $ per hour

2.

compute the underapplied or overapplied overhead for the year. (input the amount as a positive value. round your predetermined overhead rate calculation to two decimal places. round your final answer to the nearest dollar amount.)

(click to select)overappliedunderapplied overhead cost $

3.1

assume the company closes any underapplied or overapplied overhead directly to cost of goods sold. prepare the appropriate journal entry. (round your predetermined overhead rate calculation to two decimal places. round your final answer to the nearest dollar amount.)

general journal debit credit

(click to select)salaries expensedepreciation expensemanufacturing overheadfinished goodscost of goods soldwork in processraw materialsaccounts payable

(click to select)depreciation expensework in processsalaries expensefinished goodsaccounts payableraw materialsmanufacturing overheadcost of goods sold

3.2

will this entry increase or decrease net operating income?

this entry will increase net operating income.

this entry will decrease net operating income.

Answers: 1

Other questions on the subject: Business

Business, 21.06.2019 20:30, chelsilconway2262

Peppy roaney believes that pizza is a much more versatile dish than most people realize. as the national marketing manager for pizza guys, he observed how consumers were delighted with barbecue pizza, hawaiian pizza, mexican pizza and other unique combinations. his suggestions for other unusual pizzas, however, were met with a negative response by his superiors. even some of his colleagues laughed at his ideas. peppy's confidence in his ability to understand the market has led him to focus on planning a business of his own. peppy realizes that he will take a risk when he leaves his job with pizza guys and embarks upon a new venture: peppy's pizzazzeria. peppy is excited about the potential of profitably catering to the unmet desires of pizza consumers. peppy is confident that peppy's pizzazzeria will be a success, but only if he has enough money to do things right. since peppy has very little personal wealth, he knows he must obtain financial assistance. in order to prepare for meetings with bankers and p

Answers: 1

Business, 22.06.2019 02:20, gabegabemm1

The following information is available for jase company: market price per share of common stock $25.00 earnings per share on common stock $1.25 which of the following statements is correct? a. the price-earnings ratio is 20 and a share of common stock was selling for 20 times the amount of earnings per share at the end of the year. b. the market price per share and the earnings per share are not statistically related to each other. c. the price-earnings ratio is 5% and a share of common stock was selling for 5% more than the amount of earnings per share at the end of the year. d. the price-earnings ratio is 10 and a share of common stock was selling for 125 times the amount of earnings per share at the end of the year.

Answers: 1

Business, 22.06.2019 07:40, tipbri6380

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 3

Business, 22.06.2019 11:00, risolatziyovudd

%of the world's population controls approximately % of the world's finances (the sum of gross domestic products)" quizlket

Answers: 1

Do you know the correct answer?

Adriana company is highly automated and uses computers to control manufacturing operations. the comp...

Questions in other subjects:

Mathematics, 08.12.2020 23:20

Computers and Technology, 08.12.2020 23:20

Mathematics, 08.12.2020 23:20

Law, 08.12.2020 23:20

Mathematics, 08.12.2020 23:20